Modest, moderate and measured.

Those are the words the Federal Reserve is still using to describe the U.S. recovery, four years after the recession officially ended.

"Overall economic activity increased at a modest to moderate pace since the previous report," the Federal Reserve said in its latest Beige Book report, released Wednesday afternoon.

Overall, the 47-page report uses the word "moderate" 56 times and the word "modest" 54 times. It describes hiring as increasing at a "measured pace" and prices rising at a "mild" pace. Call them "the M-words."

The Beige Book stems from anecdotal information collected by each of the Federal Reserve's 12 regional districts. For example, two shopping malls in upstate New York said that business was sluggish in April, partly due to cool weather, but then picked up again in May.

Auto dealers in Philadelphia reported strong sales. A trucking company in the Cleveland region said it will have to order more trucks to keep up with rising shipping volumes.

And in Southern California, several companies said tourism has declined.

A few regions reported that companies are starting to see the effects of across-the-board government cuts. A maker of defense equipment in the Richmond region said orders were being canceled or delayed due to so-called "sequestration." Defense contractors in the Cleveland region also reported weaker business conditions.

Many districts offered up anecdotes about the housing recovery aiding businesses in their regions. Richmond, St. Louis, Dallas and San Francisco all noted increased demand for lumber. The San Francisco district said that prices for cement, logs, and lumber edged up.

A banker in North Carolina reported higher demand from home builders, and said that his bank was reconsidering whether its credit standards were too tight, given the improving economy. In contrast, bankers in the Atlanta region said that demand for loans remains weak.

Firms in several regions expressed concerns about weakness abroad. Manufacturers in the Chicago region, for example, reported declining exports of heavy machinery due to weaker demand from Europe and Asia, and petrochemical producers in the Dallas region atributed a slowdown to weakness in Europe.

Related: Bill Gross: Hey Fed, your stimulus isn't working

Overall, the report doesn't alter the picture of the U.S. economy and is unlikely to change the Federal Reserve's policies much. The Fed is currently engaged in a controversial stimulus policy through which it buys $85 billion in Treasuries and mortgage-backed securities each month in an effort to lower long-term interest rates.

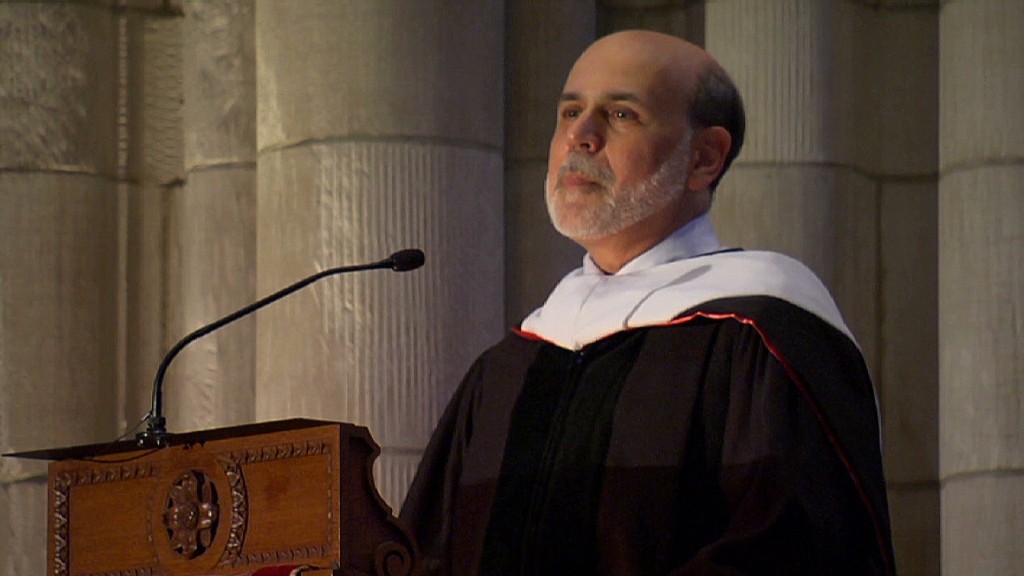

Federal Reserve Chairman Ben Bernanke has warned against "premature tightening," but also noted that the Fed could start tapering its purchases in the "next few meetings." Ultimately, he has made it clear that he's looking for substantial improvement in the job market before any changes are made.

The Beige Book hardly presents a case for "substantial improvement." In the Chicago district, employers said their uncertainty about costs related to health care reform caused them to "delay hiring plans or increase usage of temporary workers." Firms in both the Dallas and Richmond districts said they were reducing employees' workweeks to minimize their costs related to health care reform.

Several regions noted that firms had difficulty finding skilled workers in construction or engineering.

Market participants will be closely watching the next batch of jobs data, scheduled to be released Friday by the Labor Department, for further signs on that front.

Economists surveyed by CNNMoney estimate that report will show that 158,000 jobs were created and the unemployment rate remained at 7.5% in May, marking little change in the economy. Over the prior year, job gains have averaged around 173,000 each month.