A recent spate of disasters, including the Oklahoma tornadoes, the Boston bombing and the fertilizer plant explosion in West, Texas, has people across the country reaching for their wallets to help out.

But, if past trends are any indication, residents in some states tend to be a lot more generous than others.

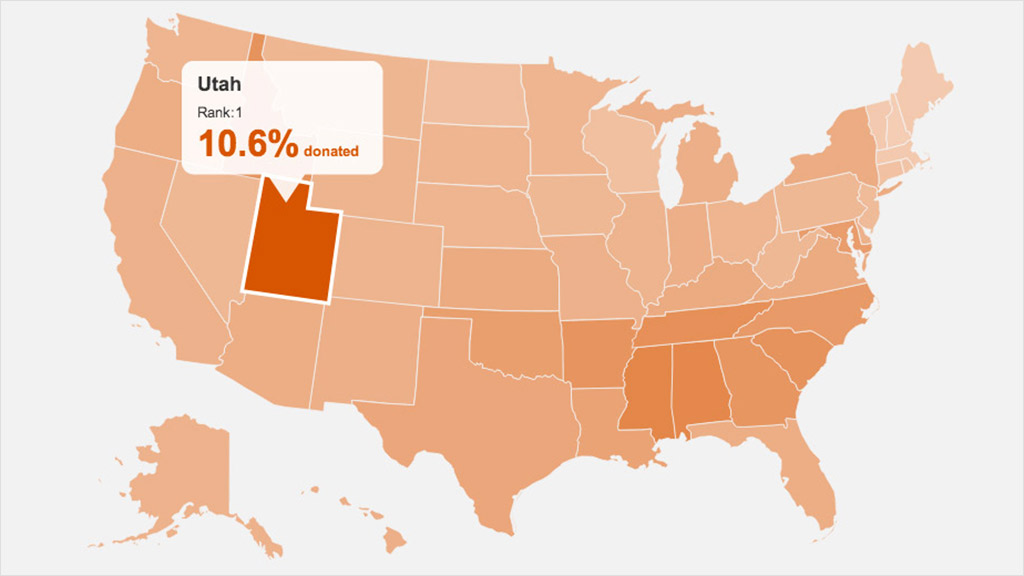

Utah, home to the nation's biggest Mormon population, is also the most charitable state, according to the Chronicle of Philanthropy's most recent report that looks at giving as a percentage of discretionary income -- your income excluding essential expenses.

Mormons are supposed to tithe at least 10% of their income to the Church of Jesus Christ of Latter-day Saints, and the median donation among Utah households lines up with that requirement -- amounting to $5,255 per household, or 10.6% of discretionary income.

Related: Where your donation dollars go

That generosity is even more impressive considering the median discretionary income in the state is less than $50,000 -- the fifth lowest in the country.

Mississippi, Alabama, Tennessee and South Carolina round out the top five, giving between 7.2% and 6.4% of annual discretionary income.

There's a direct correlation between giving and religion, the Chronicle found, with residents of Southern states donating larger portions of their income than their Northeastern counterparts.

Related: How charitable is your state?

"Giving is very much part of religion," said Daniel Borochoff, president of charity rating service CharityWatch. "The organized efforts by religious groups also motivate and inspire people to give."

The stingiest state in the country is New Hampshire, according to the Chronicle. Even though the median discretionary income in New Hampshire is over $59,000 -- one of the highest in the nation -- households in the state only gave 2.5% of that, or $1,500. Residents of Maine, Vermont and Massachusetts all donated less than 3% of discretionary income, while Rhode Islanders gave 3.1%.

Overall, residents of Southern states donated about 5.2% of discretionary income to charity, compared to 4% in the Northeast. Excluding donations to religious charities, Northeasterners outpace Southerners, giving 1.4% of discretionary income to secular charities like the American Red Cross and AmeriCares, compared with 0.9% from their neighbors to the South.

Related: Donations for Oklahoma top $20 million

The Chronicle developed its rankings by analyzing itemized charitable deductions from 2008 IRS data, the most recent available. While many donors don't itemize their taxes, there is no concrete data for unitemized donations. And because those who itemize often do so as a result of high state and local taxes or high mortgage payments and taxes, the Chronicle excluded cost of living and state and local taxes when calculating median discretionary income for each state.

And many other people who give money don't even record their donations.

"A lot of giving is done outside of organized philanthropy -- particularly now with crowdfunding -- and the poorer you are the more people you know who need charity and you give directly," said Borochoff.