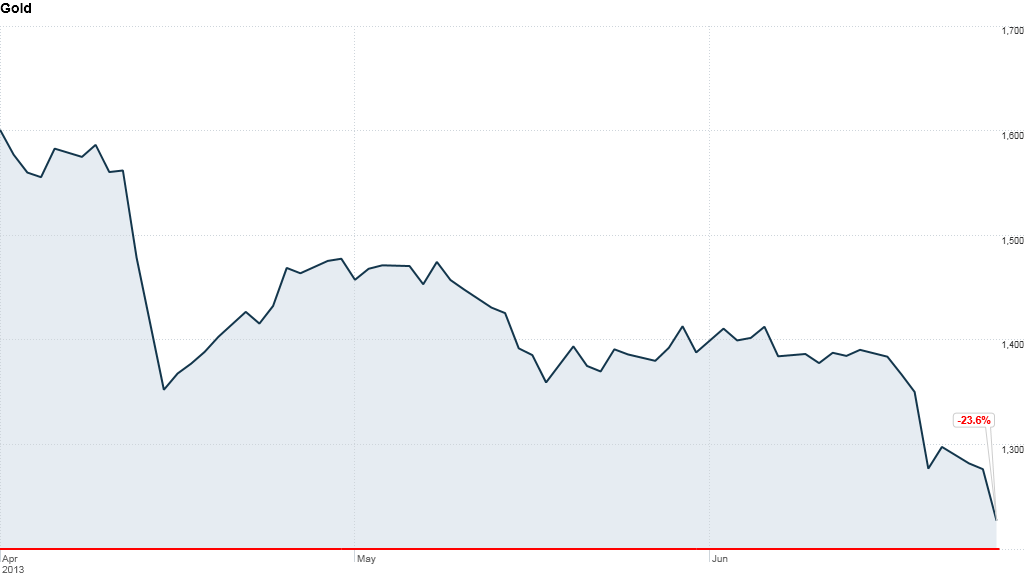

Gold prices are on track to lose nearly 25% this quarter after sliding to a 34-month low Wednesday.

The August contract for gold fell more than 4% to $1,227.10 an ounce early Wednesday, taking the price down to the lowest level since August 2010. Prices had been nearly $1,600 at the start of the quarter and had topped $1,900 for the first time last August.

If the sell-off continues, the second quarter will go down as one of the worst in decades.

Fears that the Federal Reserve will pull back on stimulus has been particularly bad for gold, which had been driven higher by worries that the Fed's stimulus efforts would weaken the dollar and cause inflation.

Related: Is gold losing its safe haven appeal

"It has been a turbulent past few weeks for the yellow metal and there seems little to suggest any let-up in the months ahead," said Ishaq Siddiqi, market strategist with ETX Capital, in a note to clients. "We could see gold prices test the $1,000 mark in the run-up to Fed tapering of stimulus."

The selling spilled over to gold miners. Randgold Resources (GOLD) and Barrick Gold (ABX) were both down more than 4%, and the SPDR Gold Shares Trust (GLD) ETF slid nearly 4%.

Gold wasn't the only precious metal taking a hit. Silver prices tumbled more than 5%.