Having failed in their many attempts to repeal Obamacare, some conservative Republicans are now trying to defund it.

The effort would starve federal agencies of the money they need to implement and enforce the Affordable Care Act. But it wouldn't necessarily render null and void the roughly $1 trillion in new taxes that the ACA is estimated to raise over the next decade.

Here's why: If conservatives succeed in defunding the ACA -- which is unlikely -- that doesn't change the law. So the tax provisions remain on the books.

Obamacare created the greatest number of tax law changes that the IRS has had to implement in two decades. The ACA tax provisions include:

- The penalty individuals would owe if they don't buy qualified health insurance starting in 2014

- The penalties employers would owe if they don't provide workers with affordable insurance starting in 2015

- Taxes and fees for insurers and medical device makers

- The Medicare surtax on high-income households

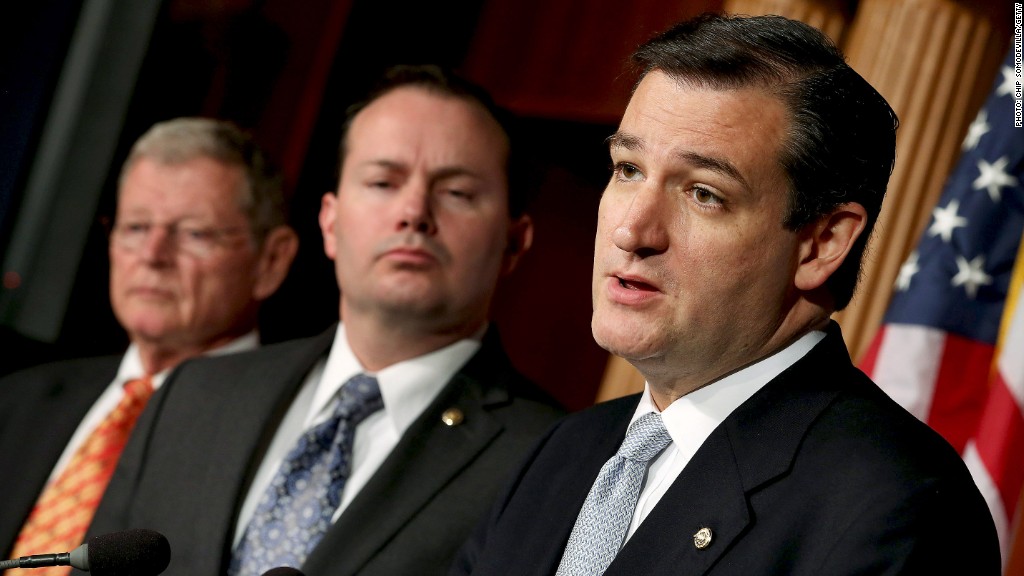

A spokesman in the office of Sen. Ted Cruz of Texas, a leader in the defunding campaign, said that if the ACA were defunded, in effect no one could be held liable for not paying ACA taxes because there would be no money for the IRS to enforce them.

Tax experts aren't convinced.

Related: IRS role in Obamacare

"Laws on the books are legally binding," said David Gamage, a law professor at UC Berkeley. "Even if the IRS stopped all auditing next year, every American would be obligated to pay taxes."

Gamage acknowledged, however, that compliance would "almost certainly go down." Though by how much is unclear.

Related: Defunding Obamacare: 5 things you need to know

It's very likely, however, that anyone who uses an accountant, a professional tax preparer or even tax software will be steered toward following the law.

"The return preparer can't sign a return that they know to be wrong," said Clint Stretch, senior tax policy counsel at Tax Analysts.

And, he noted, no one is talking about defunding the IRS Office of Professional Responsibility (OPR), which can penalize preparers if they don't follow the law.

Lastly, no one can predict how the executive branch, which is constitutionally required to implement and enforce the law, would interpret its role in the absence of ACA funding.

"The question is what discretion do the IRS and Treasury have to enforce the laws in the face of restrictions on the use of funds," said Gamage, who held a two-year position at the Treasury Office of Tax Policy, writing regulations and implementation policy for ACA provisions.