August is typically one of the dullest months on Wall Street, and in terms of trading volume, this past month was a huge yawn.

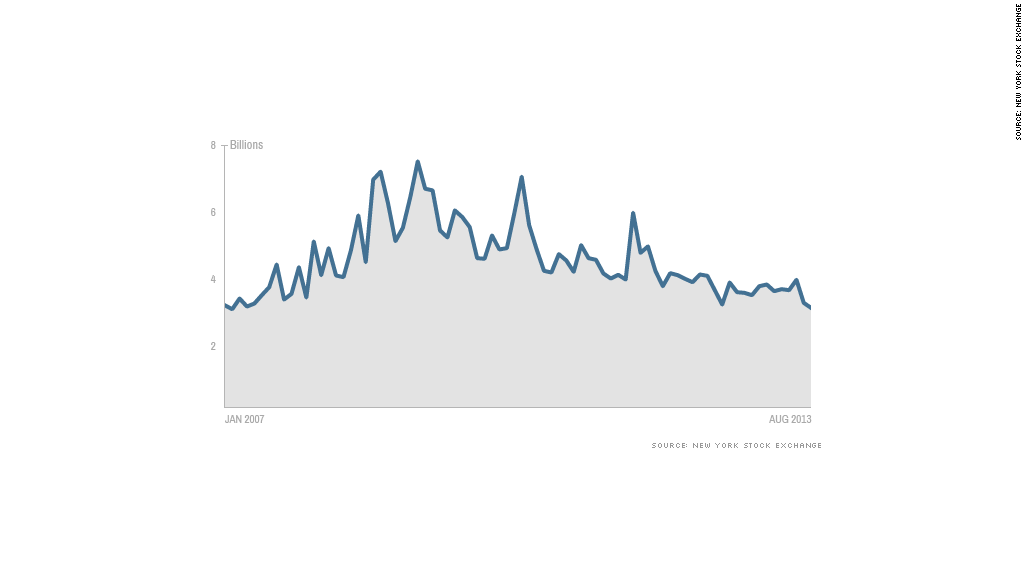

It hasn't been this quiet since February 2007, with a daily average of fewer than 3 billion shares exchanging hands on the New York Stock Exchange in August. That's even slower than last August, and about 30% below the average trading volume for August during the past five years.

What should investors take away from this as they look ahead to the rest of the year? After all, volume wasn't the only thing that was down in August. The Dow and S&P 500 logged their worst monthly performance in over a year.

Some might argue that the lackluster trading activity in a down market wasn't a sign of investors selling in a panic. Instead, there just weren't enough people around to buy stocks.

Still, it's important to note that trading volume has been trending down since the height of the financial crisis, even as stocks have surged from their March 2009 lows.

That's why investors shouldn't necessarily dismiss August's sell-off just because volume was light. You haven't heard too many people saying that this year's market rally isn't legit because of low volume. So why claim that a sell-off isn't a problem just because volume is light?

"Low volumes are the way things are now," said Joe Saluzzi, co-head of equity trading at Themis Trading. "I don't read much into it."

Related: Market volatility is back and here to stay

Saluzzi said that individual investors in general are still wary of the stock market. Even though the financial crisis is over, there have been a growing number of trading glitches lately. That's why Saluzzi thinks a lot of investors "have thrown their hands up in the air out of frustration" and have simply decided to shun stocks.

High speed traders, though still very active, have also been finding fewer trading opportunities. That's because the market, which may seem volatile now, is relatively calm compared to 2008 and 2009.

Furthermore, many investors have diversified beyond stocks and are investing in assets such as futures and options, said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research.

Historically, volumes tend to pick up in the fall as traders return from summer vacation. Last year, volume on the New York Stock Exchange jumped 20% from August to September. And with Syria concerns, a key Federal Reserve meeting, the debt ceiling/budget debate, and German elections all expected to make big headlines, traders will have a lot more news to react to over the next few months.

But nobody is expecting volume to bounce significantly higher ... and that's not necessarily terrible news. In fact, it might actually be a good thing, according to Liz Ann Sonders, chief investment strategist at Charles Schwab.

In a recent note to clients, Sonders notes that since the bull market began more than four years ago, the S&P 500 has actually done terribly on days when volume was heavy.

If you were only invested in the S&P 500 when trading volume was above its 50-day moving average, you would be down 37% since March 2009. But the index is up nearly 150% from those March 2009 lows, proof that it pays to be in the market even on days when trading volume is sluggish.

"Complain if you'd like, but gains are preferred over volume, no?" Sonders said.