Nike, Goldman Sachs (GS) and Visa (V) will be the newest members of the Dow Jones industrial average, replacing long-time components Alcoa, Hewlett-Packard and Bank of America (BAC).

The moves, announced Tuesday morning, will be effective on Sept. 23.

The 30 stocks in the Dow are a closely-watched benchmark for the health of the overall stock market and the U.S. economy, representing a variety of businesses including manufacturing, technology and finance.

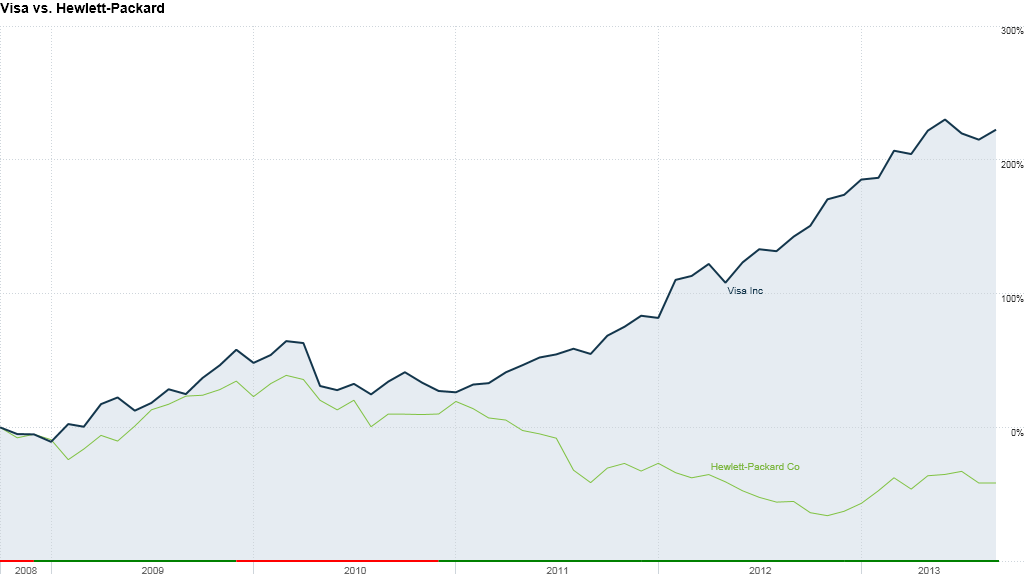

The index changes were prompted by the low stock price of the three companies slated for removal, according to S&P Dow Indices, which picks the components. Ironically, HP is the best performing stock in the Dow so far this year, with shares up 57% year to date, through Monday's close. But the gains came after several years of poor performance by all three companies.

Related: 129 years of the Dow — what's in and what's out

Low-priced stocks have limited impact on the price-weighted Dow index, said David Blitzer, chairman of the index committee at S&P Dow Jones Indices. The three companies being dropped together only represent 3% of the 30-stock index. Similarly, some very prominent companies, such as Apple (AAPL) and Google (GOOG) were not considered for inclusion in the index because of their stratospheric stock prices.

"Clearly Google and Apple are huge companies," Blitzer said during a press call. "There's no question they're very important to the U.S. and global economy. But their prices are so high they would completely distort the index."

He said the changes are not meant as an endorsement of the companies being added or a suggestion to sell the stock of companies being dropped.

Related: HP suffers from massive PC slump

"There's no intention to pick winners," he said. "Adding a stock or dropping a stock is not an investment recommendation. It's done to improve the index and make it a better indication of the market overall."

The companies being dropped also had very low market capitalization, which is the value of all their outstanding shares. Alcoa's total stock was worth less than $9 billion, making it the least valuable company. And HP's stock price is only slightly behind that of another technology giant Intel (INTC). However, Intel's market cap of $115 billion means it is worth nearly three times as much as HP's $43 billion.

The S&P Dow committee said it also wants to diversify the industries represented in the Index. Nike (NKE) will be the only apparel company in the index, while both manufacturing and technology continue to be well represented even with the departure of Alcoa (AA) and Hewlett-Packard (HPQ).

This is the first change in the composition of the Dow since insurer UnitedHealth (UNH) bumped Kraft Foods (KRFT) from the index a year ago. That move was prompted by Kraft's decision to spin off its North American grocery products business. The companies being dropped and added to the index were notified of the change at the same time as the public announcement early Tuesday.