After months of agonizing over the so-called "taper", investors will finally get some answers from the Federal Reserve this week.

At the conclusion of its two-day policymaking meeting on Wednesday, the U.S. central bank is expected to give a clear indication on when it will start to scale back on the massive economic stimulus programs that have fueled the growth and juiced financial markets since the financial crisis five years ago.

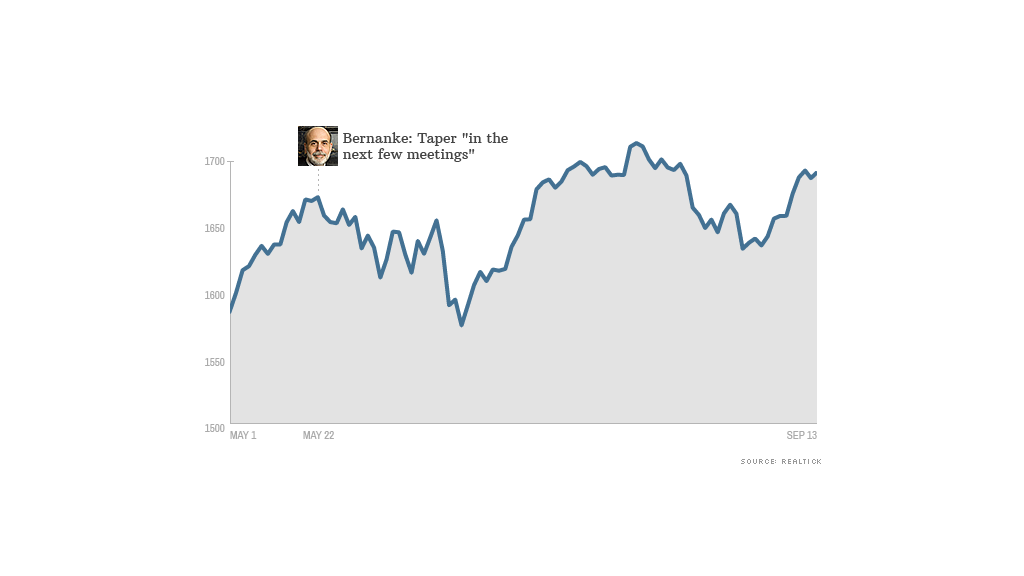

Chairman Ben Bernanke first hinted in May that the Fed may "in the next few meetings" begin tapering its policy of buying $85 billion in bonds each month. The initial comment sparked worry and confusion about the timing and the scale of the tapering, sending stocks on a volatile ride.

After some bumps, the stock rally has resumed, with the Dow and S&P 500 back up near their all-time highs. A key metric for measuring market volatility, the VIX, has dropped back to a level associated with calm markets, while CNNMoney's Fear & Greed Index sits in neutral.

Related: Markets don't care about Yellen vs. Summers

Bond yields had spiked after Bernanke's comment in May and continue to hover near two-year highs, with the Treasury's 10-year note yielding just below 3%. Because this is the benchmark on which other consumer loans are set, it has led to a spike in mortgage rates lately.

Experts say that these sharp moves will likely push the Fed to move cautiously as it curtails its bond buying program to help investors digest the change and limit market volatility.

"When the Fed starts to taper, it will only be taking its foot off the accelerator; it will not be stepping on the brake," said Gary Thayer, chief macro strategist at Wells Fargo Advisors.

Investors will also be closely listening to Bernanke's post-meeting press conference for specific details on these plans, and also the Fed's outlook on the economy.

Prior to the central bank's meeting Wednesday, investors will also have a chance to react to former Treasury Secretary Larry Summers' decision on Sunday to withdraw his name from consideration to succeed Bernanke as head of the Fed.

Investors cheered on Sunday, sending stock futures higher on Summers' move, as it will avoid a contentious Senate confirmation process. However, overall, the cheer isn't expected to last, because markets participants have viewed the race as a non-event.

Bond markets could react with "downward pressure" on the 10-year Treasury note yield, according to Steven Englander, global head of foreign exchange strategy at Citi.

In addition to the Fed, investors will have a few earnings reports to chew on, as FedEx (FDX) and Oracle (ORCL) open up their books. Also following Twitter's announcement last week that it is has filed for a planned IPO, investors will be on the watch for documents that reveal its financial information, even though there is the possibility the company might decide to keep that private for now too.

On the economic front, investors will have reports on regional manufacturing activity, inflation, housing starts and existing home sales to parse through.

And while Syria has been on the backburner in anticipation of a diplomatic deal for some time, investors may breathe an official sigh of relief after Russia and the United States reached a groundbreaking deal on a framework to eliminate the war-torn country's chemical weapons.