Markets are in a cautious mood Tuesday as investors focus on a meeting of the U.S. Federal Reserve, which could decide to trim its quantitative easing program.

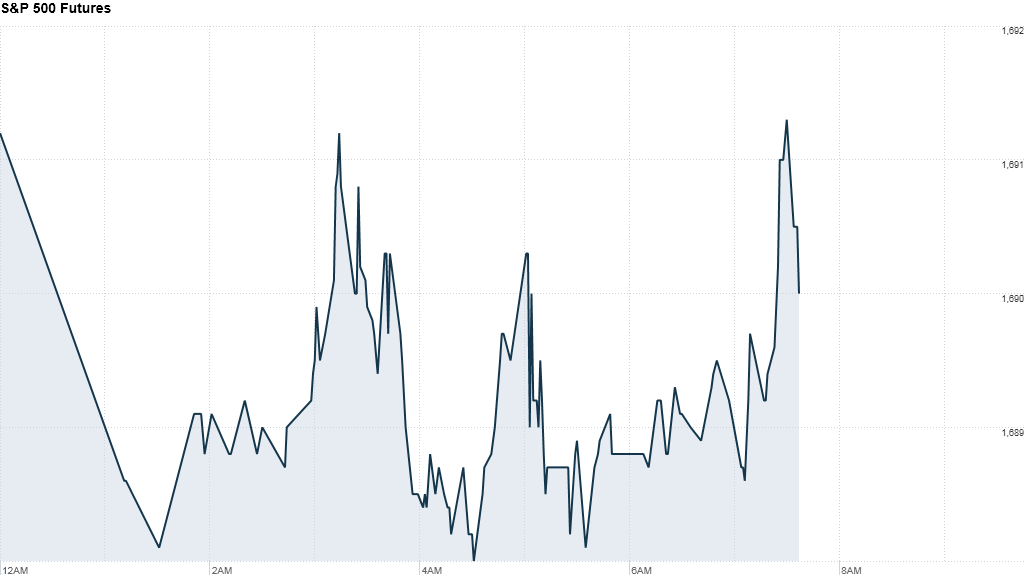

U.S. stock futures were flat ahead of the opening bell.

The Fed has been pumping liquidity into the system by buying bonds and other securities worth $85 billion per month, providing support to markets around the world. Investors are concerned about the impact that scaling back this massive program will have on stocks and bond yields.

An announcement on so-called tapering could be made Wednesday.

Related: The taper is coming. Get over it

Investors are also waiting on the Bureau of Labor Statistics, which will release the August edition of its Consumer Price Index at 8:30 a.m. ET. This is the government's key metric for inflation and it's expected to have notched up 0.2% last month, according to a Briefing.com consensus.

At 9 a.m., the Treasury Department will release its monthly report on international capital flows.

Related: Fear & Greed Index still in neutral

In corporate news, Adobe Systems (ADBE) is scheduled to report quarterly results after the closing bell.

U.S. stocks finished with mixed results Monday, with the S&P 500 closing near a record high. The Dow Jones Industrial Average also surged, but the Nasdaq pulled back, dragged down by declining Apple (AAPL) shares.

All major European markets were weaker in morning trading, in part in response to a fall in European monthly car sales in August. Shares in Fiat (FIADF) and Volkswagen (VLKAF) were down by roughly 1%.

Asian markets were mostly heading lower Tuesday, with the Shanghai Composite index leading the way with a 2% drop.