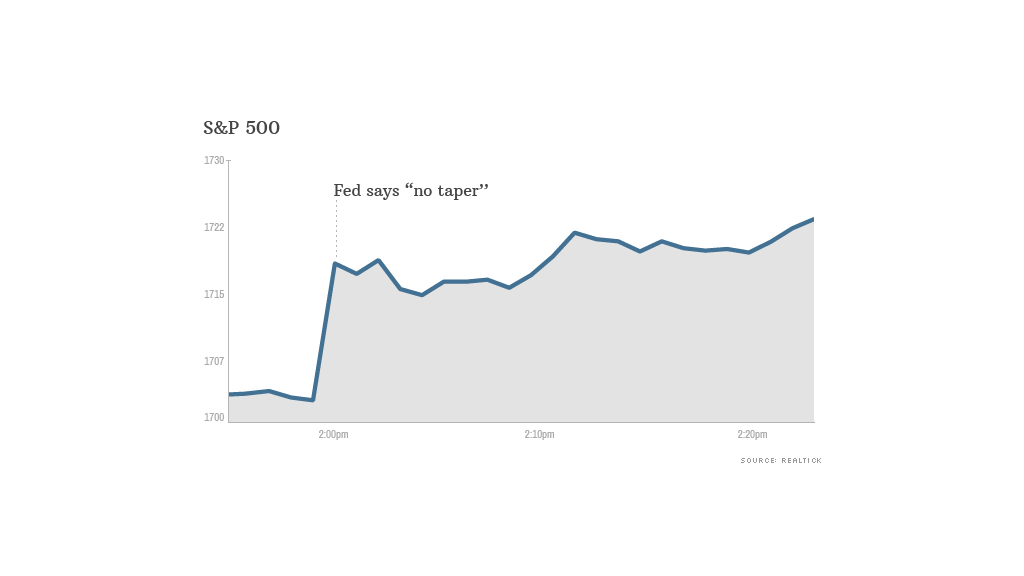

The market erupted Wednesday afternoon immediately after the shocking "no taper" news from the Federal Reserve. The reaction was so fast, it left many people wondering how any human could have read and comprehended the Fed statement that quickly.

Even though the Fed waited until the third paragraph to say that it was not yet ready to scale back its bond buying program, stocks surged on a big spike in volume within microseconds, or one thousandth of a second of the release.

Eric Hunsader, founder of the market research firm Nanex, said he's never seen traders react as quickly to an economic announcement.

Related: High speed trading puts investors on losing end

Such is the effect of so-called high speed trading, where computers can be programmed to unleash millions of trades per milliseconds. Algorithms can react before any human could possibly digest information, much less trade on it.

Now if you are an investor that's in stocks for the long haul, you don't have much to complain about. Your 401(k) likely rose in value on Wednesday. But if you are a trader trying to time sudden turns in the market, it's hard to beat the machines.

A gold leak? Traders in the gold market were also looking at odd spikes in the price of electronically traded futures in the minutes leading up to the Fed announcement.

On an otherwise extremely light day of gold trading, the price of gold futures jumped roughly $8 at 1:57:30 to $1,318 an ounce, according to Nanex data. Volume popped as well.

Related: The computers that run the stock market

And anyone that moved into gold before the Fed announcement was rewarded handsomely. After the 'no taper" news, gold prices continued to soar, moving above $1360.

The fact that some traders were willing to bet on gold before the Fed was a bit curious. After all, gold has been a losing trade for most of 2013. Prices were down more than 20% this year leading up to the Fed news. And that's because many investors felt the Fed would taper in September. That would be bad for gold., which had been a big beneficiary of the Fed's bond buying up until a few months ago.

"The simplest explanation seems to be that the information was leaked to significant players and entities, and they were able to get out in front of everyone else," said Scott Carter, CEO of Lear Capital, a precious metals trading firm.

The SEC declined to comment on whether they are looking into trading before and after the Fed announcement.

A spokesperson for the Commodities Futures Trading Commission, which oversees trading in commodities, said that the agency routinely reviews big trades and will likely do so in this instance.