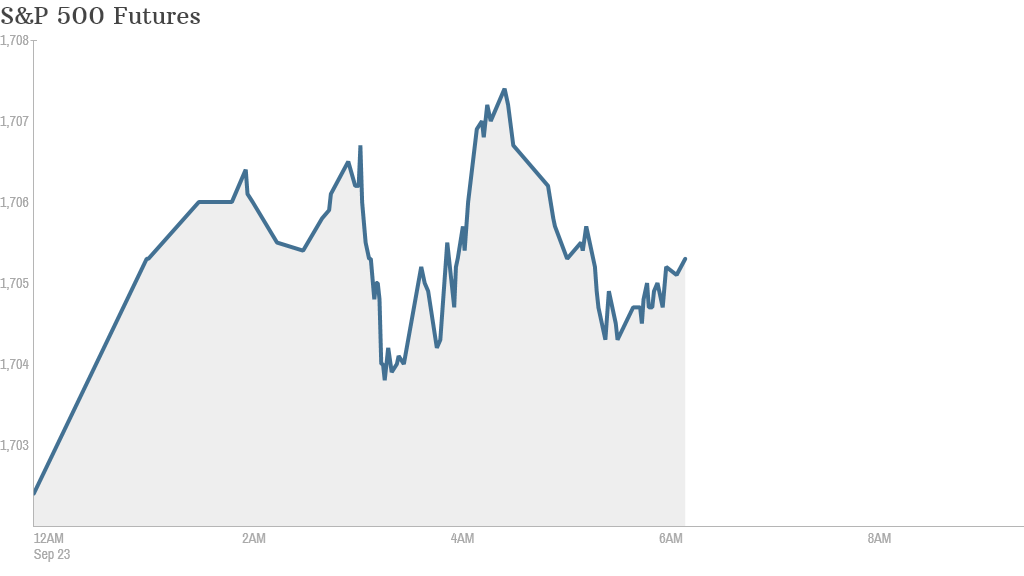

It looks like the trading week could start on a positive note.

U.S. stock futures were higher Monday, indicating some stability after the sharp fall at the end of last week.

The market mood was bolstered by new data from HSBC showing China's manufacturing sector expanded at the fastest pace in six months.

But with few major corporate or economic reports on tap, trading volume could be light.

Related: Fear & Greed Index, still greedy

U.S. stocks fell Friday, with investors facing further uncertainty about the Federal Reserve and a possible government shutdown in October. However, they finished higher for the week, after gaining on the Federal Reserve's surprise decision to maintain the pace of its massive bond-buying program.

Related: Government shutdown, Fed timing looms large

European markets were mixed in morning trading, with stocks edging into positive territory as eurozone purchasing managers reported slightly stronger-than-expected growth in manufacturing and services.

German chancellor Angela Merkel's big victory in Sunday's elections also helped early sentiment as voters backed her handling of the euro zone crisis and Europe's biggest economy. But European stocks eventually lost momentum, withe Frankfurt's DAX index, which has gained 14% so far this year, little changed for the day.

Asian markets ended with mixed numbers Monday. The Shanghai Composite index rose by 1.3%, in part because of the positive manufacturing data. The Shanghai markets were back from an extended holiday period.

Meanwhile, Hong Kong was closed in the morning because of Typhoon Usagi. But trading resumed in the afternoon and the Hang Seng index dropped by 0.6%. The Tokyo Stock Exchange was closed for a holiday.