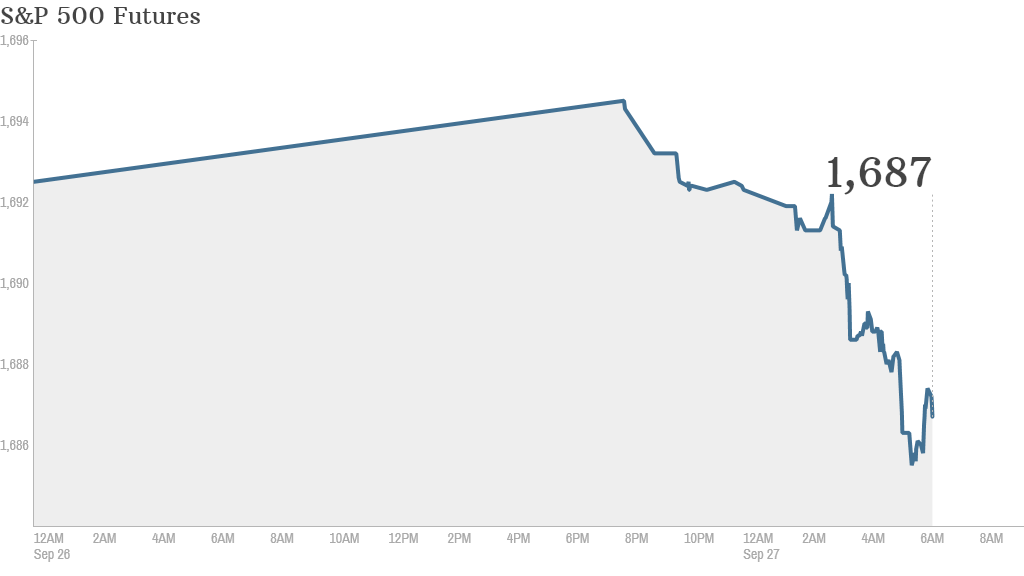

It looks like markets could start Friday in the red and close out the week with a loss as uncertainty over the economic impact of political squabbling in Washington continues to worry investors.

U.S. stock futures were all lower.

Investors continue to fret over how Washington will deal with a possible government shutdown and a debt ceiling that could keep the government from paying its bills.

Many expect Congress will strike a last-minute deal to raise the debt limit, allowing the government to keep paying for things such as Medicare and the military. However, the uncertainty has kept the markets in check.

"The permanent loss of income for nearly a million government workers... and paycheck delays to a larger group by Oct. 15 would weigh on consumer demand and retailers anticipating Thanksgiving and Christmas activity," said Ashraf Laidi, chief global strategist at City Index.

U.S. stocks rose slightly Thursday, but had drifted lower in the five previous trading sessions, with both the S&P and Dow indexes coming off record highs last week.

Related: Fear & Greed Index still possessed by fear

The Commerce Department is scheduled to release its monthly report on personal income and spending at 8:30 a.m. ET. At 9:55, the University of Michigan and Thomson Reuters will release the latest edition of their consumer sentiment index.

Blackberry (BBRY), which announced plans this week to go private, is set to release quarterly results before the opening bell. The stock fell 6% before the bell.

Nike (NKE) shares jumped 6% in premarket trading following quarterly results that beat expectations.

J.C. Penney (JCP) shares sank 7% in premarket trading following news that the struggling retailer is planning a public offering of 84 million shares.

Related: China to launch mysterious free trade zone

European markets were drifting lower in midday trading.

Asian markets closed higher Friday after China announced that its establishing a free trade zone in Shanghai, driving up the shares of companies with Shanghai in their names. The Nikkei dipped lower while Chinese indexes edged up.