The U.S. dollar weakened Tuesday as the United States federal government began to shut down but stock markets around the world mostly shrugged off the risk to economic growth.

The White House has ordered agencies to shutter their doors, initiating a shutdown after lawmakers were unable to agree on a short-term extension of government funding.

The stakes are high. A government shutdown could cost the U.S. economy roughly $1 billion a week in pay lost by furloughed federal workers.

Economists say the impact will come not just from those lost wages, but also from related businesses cutting back or halting their operations.

"No doubt, everyone's gaze is firmly set on Washington, D.C.," said HSBC economist Frederic Neumann.

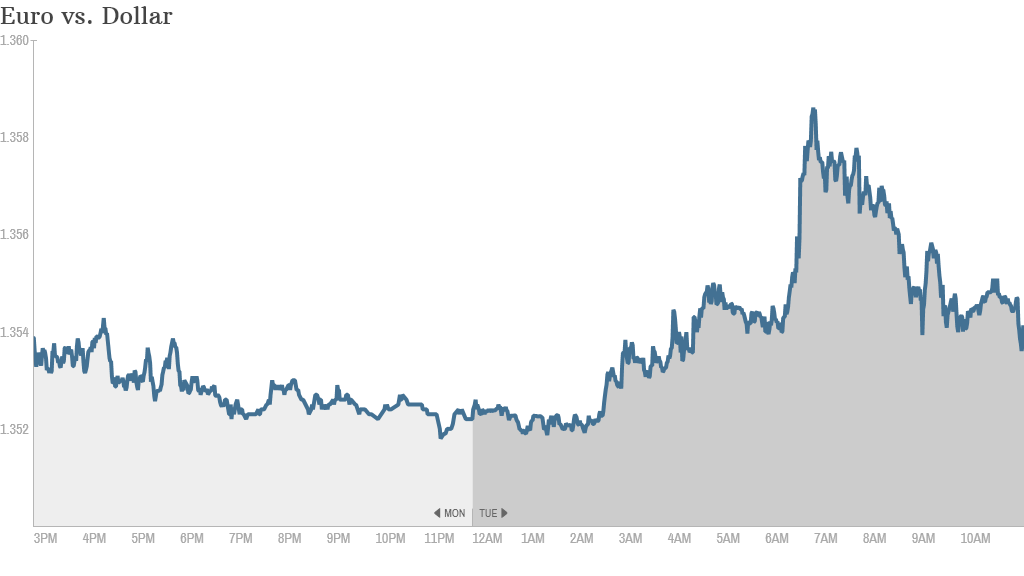

Despite the threat to growth, stock market reaction around the world was muted. But the U.S. dollar stumbled 0.4% against a basket of global currencies and fell to its lowest level against the euro for seven months.

Related story: Japan debt tops 1 quadrillion yen

In Europe, Germany's DAX gained 0.6% and France's CAC 40 was also firm. London's FTSE 100 bucked the trend, slipping about 0.2% after Unilever (UL)warned of slowing sales in emerging markets due to plunging currencies.

The Australia ASX All Ordinaries swung between gains and losses all day, ending down 0.2%. Tokyo's Nikkei closed up 0.2% while India's Sensex added 0.6% after the country's current account deficit widened less than expected. Exchanges in Hong Kong and China were closed for a holiday.

In Japan, the focus was on a tax hike and the quarterly Tankan survey, which showed business confidence at its highest level in years.

Related story: Women hold key to fixing Japan's economy

Markets in Korea and Taiwan were also supported by strong expansion of factory activity, according to a survey by HSBC. Korea's September purchasing managers' index rose to a four-month high of 49.7, while Taiwan's September PMI surged to an 18-month high of 52. China's official PMI climbed to 51.1 in September.