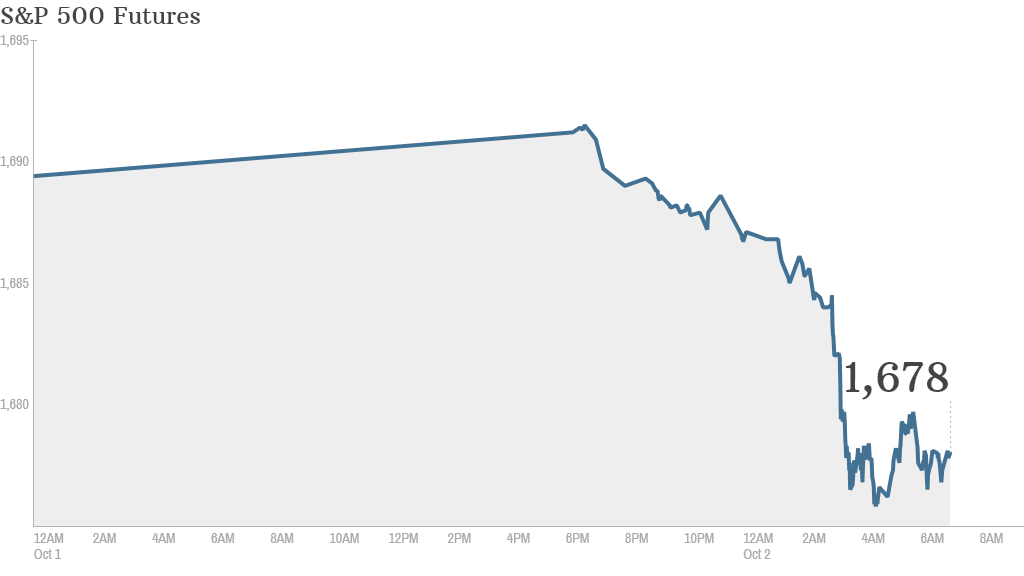

Investors are starting to worry that the political stalemate in Washington will hurt growth and put the country at risk of being unable to pay all of its bills later this month.

U.S. stock futures were weaker across the board as the government shutdown heads into Day 2.

With Congress unable to agree on a deal to fund the government past Monday, more than 800,000 federal workers are being furloughed without pay this week. In addition, government agencies are curtailing their services, and federal museums, parks and monuments are closed to the public.

And Treasury Secretary Jack Lew said Tuesday that the government has started to use the last of its "extraordinary measures" to ensure it stays below debt ceiling. If the ceiling isn't raised, the risk of a U.S. default will rise.

Related: Federal workers sound off on the shutdown

Payroll processor ADP's monthly report on private-sector jobs showed that the U.S. added 166,000 jobs in September, slightly below expectations. The report didn't move markets Wednesday morning, although it has more significance this month that usual. The U.S. government's monthly unemployment report is unlikely to be released this Friday because of the government shutdown.

Shares of agriculture technology firm Monsanto (MON) dropped in premarket trading after the company missed earnings expectations.

Also, the Empire State Reality Trust, which owns the Empire State Building and other real estate holdings in the New York City area, will start trading Wednesday as a public company after raising $930 million through an initial public offering. The stock will trade as ESRT on the New York Stock Exchange.

Related: Fear & Greed Index still languishing in fear

U.S. stocks finished higher Tuesday, initially shrugging off the government shutdown on hopes that it may be short-lived.

European markets were weaker in midday trading, weighed down by worries about the U.S.

The European Central Bank left interest rates unchanged after its latest policy meeting. ECB President Mario Draghi will speak around 8.30 a.m. ET.

Asian markets ended mixed. Hong Kong's Hang Seng gained 0.5% in response to Wall Street's rally.

Japan's Nikkei opened flat but lost momentum through the day, eventually closing 2.2% lower as investors considered the tax hike and stimulus plan announced Tuesday by Prime Minister Shinzo Abe. The tax hike should slow growth, and it remains unclear whether the ¥5 trillion stimulus will be enough to offset the hit to Japan's economy.

The Shanghai Stock Exchange was closed for the National Day celebration.