Investors are braced for another downbeat session on markets Thursday as Washington remains paralyzed and a deadline for raising the U.S. debt ceiling looms.

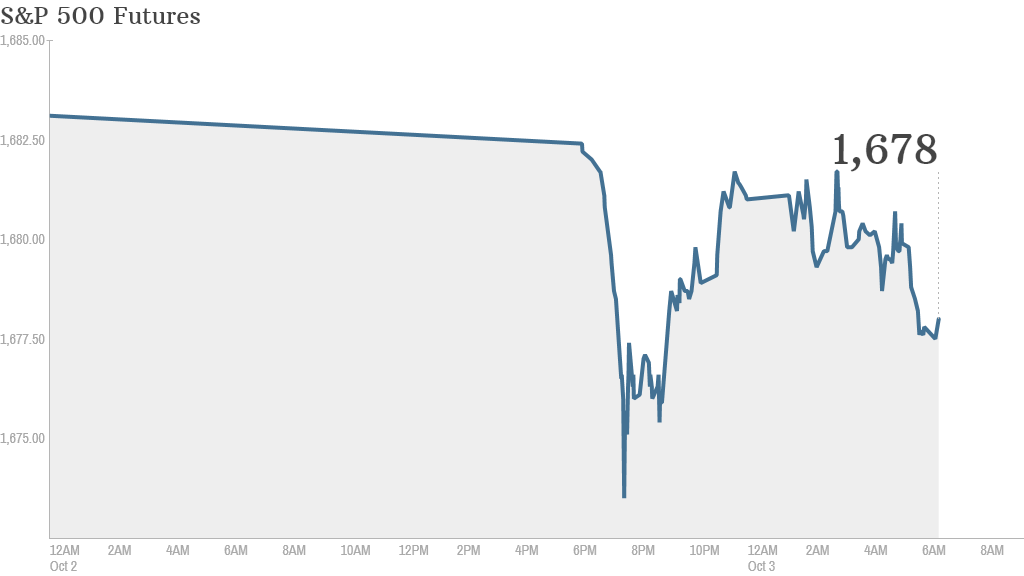

U.S. stock futures were lower ahead of the opening bell, with the S&P 500 contract down 0.3%.

With meetings at the White House between congressional leaders and President Obama failing to produce a breakthrough, the federal government shutdown has entered its third day.

"I think probably at the beginning of the week people didn't think it would take so long to sort out," said David Jones, chief market strategist at IG Markets in London. "The fact that it's dragged on is making people a little bit nervous. This thing has definitely dented people's appetite for risk."

Related: Debt ceiling: Countdown to default

More troubling for Wall Street is the risk that the political stalemate could prevent a raising of the debt ceiling, meaning the government may not be able to pay all its bills later this month.

Despite the shutdown, the U.S. is set to release its weekly report on initial jobless claims at 8:30 a.m. ET Thursday.

Related: Fear & Greed Index still consumed by fear

U.S. stocks fell slightly on Wednesday. All three major indexes closed with modest losses, pulling back from steeper drops in morning trading. The Dow Jones industrial average has dropped for eight of the past 10 trading days.

United Technologies (UTX) dropped more than 2% Wednesday after the defense contractor announced that it would likely furlough 2,000 workers starting next week, thanks to the government shutdown. About 800,000 federal employees have already been furloughed.

Asian markets ended mixed. Hong Kong's Hang Seng advanced 0.9%, buoyed by data that showed China's services sector is continuing to gain strength. Shanghai's exchange remained closed for a holiday. In Japan, the Nikkei closed 0.1% lower.

European markets were mixed at midday as worries about the U.S. countered optimism about China.