The debt ceiling deadlock is finally starting to rattle investors.

During the first six days of the government shutdown, investors had a relatively blasé attitude toward the drama in Washington. But as a critical Oct. 17 deadline approaches, stocks continue to fall.

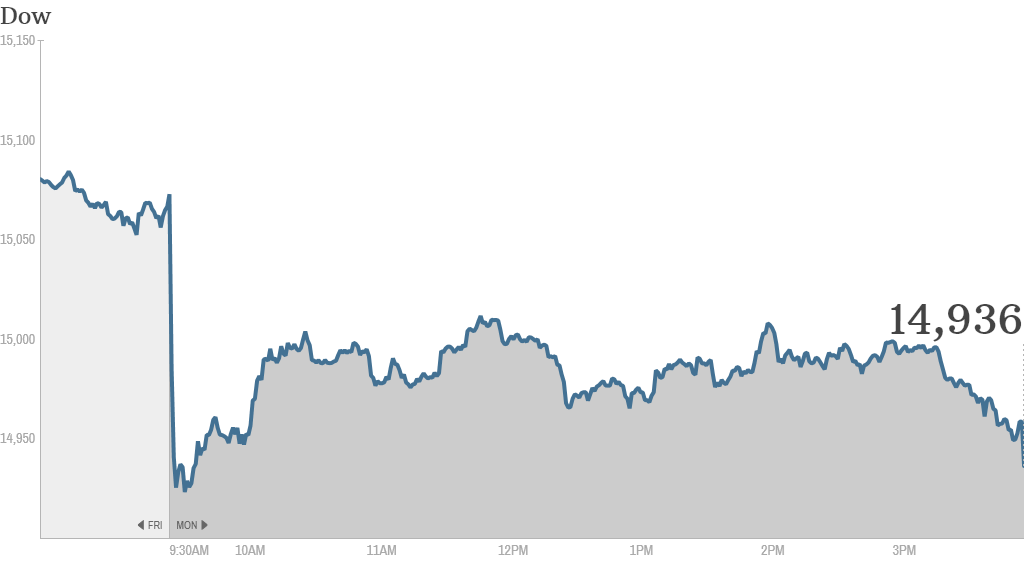

The Dow Jones industrial average, the S&P 500, and the Nasdaq closed down nearly 1% Monday.

Click here for more on stocks, bonds, currencies and commodities

Congress waiting for a sell-off? Several analysts say that a sharp sell-off in stocks could be the one thing that pushes Congress to act swiftly.

So far, stocks have been holding up pretty well..

"A resilient stock market and a cloudy economic picture increase the risk of an extended shutdown in our view," Bank of America analysts wrote in a report over the weekend.

The government shutdown is in day 7, and lawmakers appear no closer to resolving the impasse.

Related: Shutdown, debt ceiling uncertainty looms

Sounding the alarm on the debt ceiling: Treasury Secretary Jack Lew said Sunday that Congress was "playing with fire," with the possibility of a U.S. default only a little over a week away.

Deutsche Bank analyst David Bianco thinks the lack of a debt resolution will drag on the S&P 500 this week, but says there's little chance that the U.S. will default.

However, if it does, Bianco says the S&P 500 could sink 45%.

That echoes the sentiment of ETX Capital market strategist Ishaq Siddiqi, who said the debt ceiling debacle could lead to a "subsequent meltdown of global asset prices."

Last week, Bank of America analysts said the government shutdown wouldn't impact fourth-quarter GDP growth. But over the weekend, they changed their tune and lowered growth estimates for the fourth quarter to a 2% annual rate from 2.5%.

Related: Fear & Greed Index, still dwelling in fear

Earnings kick off this week: The first corporate results for the third quarter come out Tuesday, when aluminum maker Alcoa (AA) reports after the market close.

Two of the biggest banks -- Dow component JPMorgan Chase (JPM)and Wells Fargo (WFC) -- report Friday morning. Bank stocks, including JPMorgan, Bank of America (BAC), Citigroup (C), and Goldman Sachs (GZPHF), dropped nearly 2%.

Analysts fear that weak third-quarter earnings could also weigh on stock prices.

Related: Fed taper won't cause another Asia financial crisis

What's moving: Shares of Apple (AAPL) rose after the iPhone maker was upgraded by Jefferies analyst Peter Misek.

"$AAPL Haters be Damned, Peter Misek Has Been Great on Apple (AAPL) Target = $600 http://stks.co/alZL Bullish," StockTwits users TimZ wrote.

Still with Apple down nearly 30% from its all-time highs hit in 2012, many investors are still skeptical. "$AAPL "It's Tough to Get Past the Idea That Tim Cook Has 'No Clue'" http://stks.co/blUN," wrote ValTheGal.

Shares of BlackBerry (BBRY)gained nearly 4% on talk that new buyers are emerging for the troubled smartphone maker.

The buyers, according to reports, could consider buying Blackberry in parts. That's giving investors at least some hope that a deal may actually get done.

"$BBRY $BB.CA Financial Post: "BlackBerry survival seen in security not smartphones" http://stks.co/tVS7 Bullish," rgb66rgb wrote on StockTwits.

But some traders noted that looking at BlackBerry is a far cry from buying it.

"$BBRY Any Large corp looking for growth, will analyse the potential of any company, specially those with Billions in revenues," wrote i7up2001.