Investors are waiting for further progress in Washington on resolving the debt ceiling standoff before they push shares any higher.

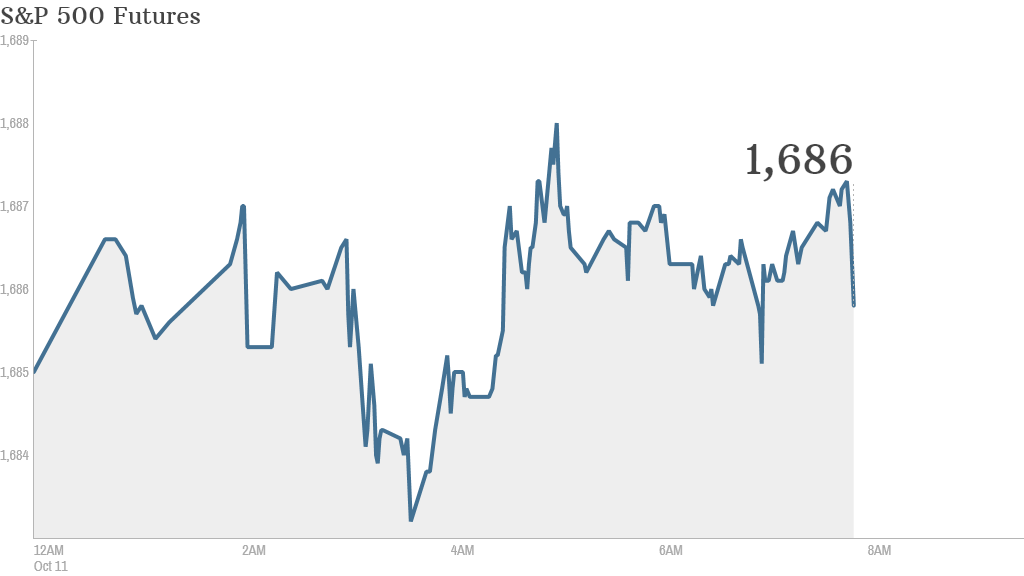

U.S. stock futures were modestly higher Friday as investors wait to see whether a deal can take shape.

"The overnight headline that Obama had sent the Republican proposal back to the drawing board caused a short wobble in overnight markets," wrote Deutsche Bank analyst Gael Gunubu. "But sentiment has since bounced back with S&P 500 futures recovering from earlier lows to post a 0.1% as we type."

A surge of optimism reigned on Wall Street Thursday as it seemed Washington was beginning to sort out its debt ceiling issues.

That prompted a major relief rally in U.S. stocks, with the Dow Jones Industrial Average making its largest gain of 2013.

Thursday's rally came even as a damaging partial shutdown of the federal government moves into its 11th day with no end in sight.

In addition to the debt ceiling talks, the first of the big banks started reporting quarterly results.

JPMorgan (JPM) posted a quarterly loss due to costs of legal actions from the government. The bank still managed to top forecasts, excluding charges. The stock rose nearly 3% in premarket trading.

Wells Fargo (WFC) reported significant increases in quarterly sales and profit, compared to a year ago. The stock edged up ahead of the bell.

Related: Fear & Greed Index wallowing in fear

At 9:55 a.m. ET, the University of Michigan and Thomson Reuters will release the latest edition of their consumer sentiment index.

According to a recent Gallup poll, consumer confidence registered its sharpest one-week drop since the period immediately following the collapse of Lehman Brothers, with people worried about how the fracas in Washington could hit their wallets.

Related: Sharp drop in consumer confidence

European markets were mostly higher in midday trading led by London's FTSE 100, with a gain of 0.7%. One star performer on the London Stock Exchange -- Royal Mail -- saw shares soar by more than 30% as it started trading following a much sought-after initial public offering.

Asian markets closed with big gains. Japan's Nikkei surged by 1.5% and the Shanghai Composite index shot up by 1.7%.