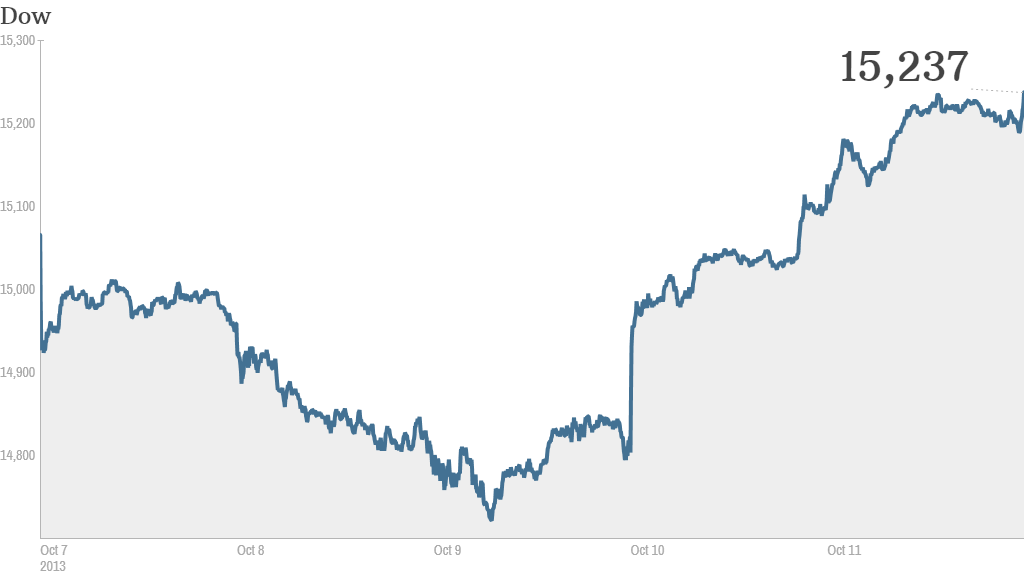

After one of the biggest rallies of the year, stocks moved higher again Friday as investors wait for further progress in Washington on resolving the debt ceiling standoff.

The Dow Jones industrial average climbed more than 100 points, or 0.7%. The S&P 500 rose 0.6% to close above 1,700 for the first time since September 23. The Nasdaq was up 0.8%.

The gains came a day after a surge of optimism that sent the Dow up more than 320 points, its biggest point jump since December 2011. The S&P 500 and Nasdaq delivered their second best advances of the year.

Thanks to the big rally, the Dow and S&P 500 ended the week higher for the first time in three weeks. The Dow gained more than 1% for the week, while the S&P 500 gained 0.8%. Both indexes are now above the level they were at before the shutdown began at the start of the month.

The Nasdaq ended the week with a slight decline, its first down week since August. Some of the best-performing tech stocks of the year, such as Netflix (NFLX) and Facebook (FB), fell sharply this week.

Progress, but no deal: Following some progress on Thursday, House Republicans met again with President Obama Friday and offered a plan that would temporarily increase the debt ceiling without reopening the government right away. A deal has yet to be made, but the ongoing talks are seen as a sign of significant progress following weeks of gridlock.

"While a short-term extension would not eliminate uncertainty ... it would reinforce our conviction that most members of Congress are not irresponsible enough to actually follow through on threats to not raise the debt ceiling limit," said Jim O'Sullivan, chief U.S. economist at High Frequency Economics, in a note to clients.

Related: Fear & Greed Index still shows fear

JPMorgan Chase reports first loss under Dimon: In addition to the debt ceiling talks, the first of the big banks started reporting quarterly results.

JPMorgan Chase (JPM) posted a quarterly loss due to costs of legal actions from the government. It was the company's first since Jamie Dimon took over as CEO in 2004.

Dimon called the bank's legal tab "painful" and warned that litigation costs could continue to be a drag on earnings for several quarters. The bank noted that it is holding $23 billion in reserves for potential litigation expenses.

"I am not paying my taxes until $JPM pays their $23 billion in fines," quipped howardlindzon on StockTwits.

But another user hopes JPMorgan Chase can go back to making profits soon.

"$JPM Obama leave Jamie alone so we can make some $$$$$$$$$$," said justagal.

The bank still managed to top forecasts, excluding charges. The stock ended flat.

Wells Fargo (WFC) reported significant increases in quarterly sales and profit, compared to a year ago. However, shares of the bank fell amid signs that its mortgage business weakened during the quarter.

"$WFC AND $JPM both show mortgage market has frozen as the rates rise," said StockTwits user JJSinghSTARR.

Related: Sharp drop in consumer confidence

Consumer confidence waning : The University of Michigan and Thomson Reuters' gauge of consumer sentiment fell in October to the lowest level since January, according to a preliminary reading.

Separately, a recent Gallup poll showed that consumer confidence registered its sharpest one-week drop since the period immediately following the collapse of Lehman Brothers, with people worried about how the fracas in Washington could hit their wallets.

Britain's postal service surges in London IPO: European markets were mostly higher in afternoon trading led by London's FTSE 100, with a gain of 0.9%. The star performer on the London Stock Exchange was Royal Mail, the British mail service that soared nearly 40% in its stock market debut.

Asian markets closed with big gains. Japan's Nikkei surged 1.5% and the Shanghai Composite index shot up 1.7%.