Markets are set for a choppy Wednesday with investors and traders on edge as they wait for Washington to strike a last-minute deal to avoid a debt debacle that would see the country unable to pay all its bills.

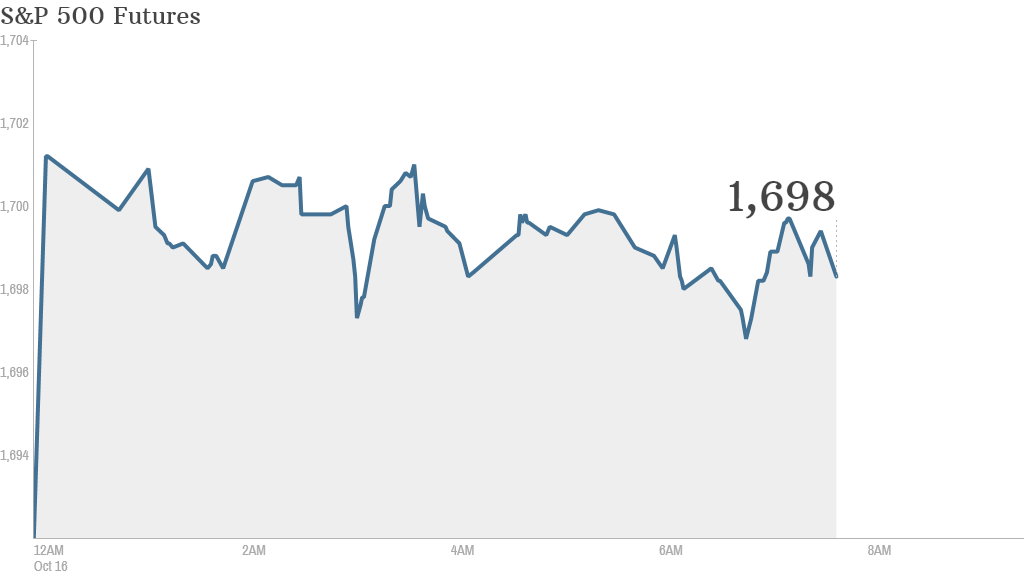

U.S. stock futures were edging higher, looking to recover from a sharp drop Tuesday when lawmakers in Washington wrangled over the budget deal. Both the Dow Jones Industrial Average and the S&P 500 were up by roughly 0.4% ahead of the open.

Investors remain cautious as they wait to see if lawmakers will come to an agreement before Thursday's debt ceiling deadline. A failure to reach an agreement could trigger a default on U.S. debt and chaos in global markets.

Yields on short-term Treasury bills are rising as investors worry about the possibility that the U.S. may not be able to settle its debt. The U.S. auctions one-month T-bills and one-year notes Wednesday.

At the same time, gold prices are edging up as investors seek a safe-haven asset.

Rating agency Fitch put the U.S. on notice Tuesday afternoon, warning it could downgrade America's AAA credit rating, citing the "political brinkmanship" on display in Washington.

There were also earnings results to parse through Wednesday.

Shares in Bank of America (BAC) were edging up ahead of the opening bell after the firm reported better-than-expected third quarter results.

Mattel (MAT) shares were spiking by roughly 5% in premarket trading after the Barbie manufacturer reported first quarter results that beat analyst estimates for revenue and profits.

Shares in Stanley Black & Decker (SWJ) were tumbling by roughly 10% ahead of the open after the power tools maker lowered its full-year earnings outlook. The company said it expected "uncertainty created by the U.S. government's sequestration and shutdown" to hurt business and consumer spending.

Meanwhile, shares in BlackRock (BLK) and PepsiCo (PEP) were moving sideways in premarket trading after both firms released their latest quarterly results, which beat analyst expectations.

American Express (AXP), IBM (IBM) and eBay (EBAY) are set to report after-hours.

Related: 6 ways a U.S. default could hurt the world

After the bell Tuesday, Twitter announced plans to list on the New York Stock Exchange.

Intel (INTC) shares slipped in premarket trading after the chipmaker issued a pessimistic outlook for the rest of 2013 and lowered its profit forecast in its after-hours earnings report Tuesday.

European markets were under pressure in morning trading as investors around the world fret about the political mess in Washington.

Asian markets ended with mixed results, as investors adopted a wait-and-see mentality.