It's all about the jobs report.

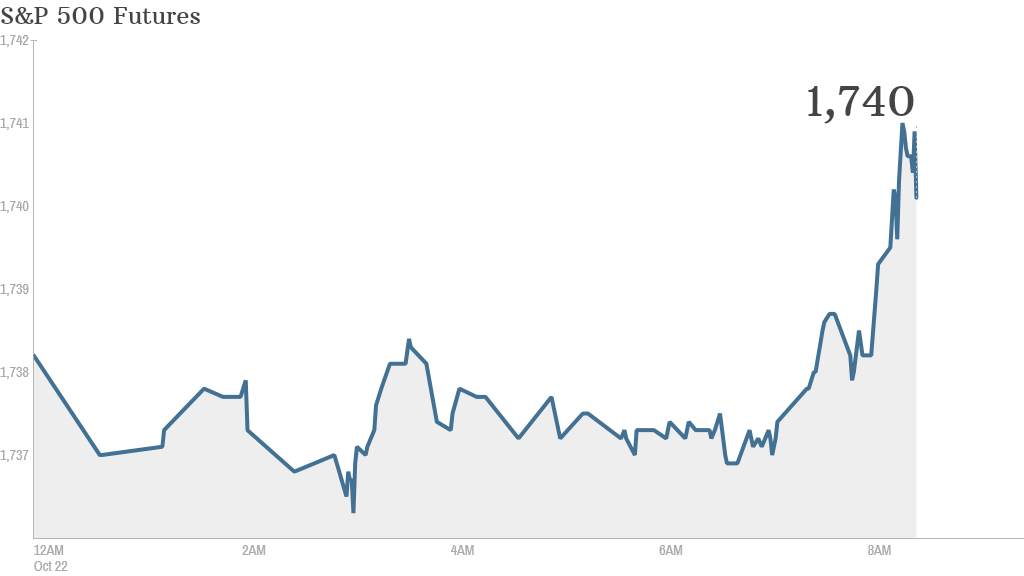

U.S. stock futures edged slightly higher Tuesday as investors digested a lackluster September jobs report, which was delayed because of the federal government shutdown.

The report showed that the economy gained 148,000 jobs last month, far fewer than the 183,000 economists were expecting. The unemployment rate ticked down to 7.2%, the lowest November 2008.

The weak numbers suggest that the U.S. economic recovery remains fragile, and the Federal Reserve will likely maintain the pace of its massive stimulus program, which entails $85 billion in bond purchases each month, for a bit longer.

Improvement in the jobs market is a vital factor for the Fed's decision to begin tapering, or scaling back its bond buying program. Most economists forecast the central bank won't begin tapering until 2014.

However, because the September report wasn't affected by the shutdown, it may not have the same impact on the Fed's thinking as October's report.

U.S. stocks finished mixed Monday.

Related: Fear & Greed Index, back to extreme greed

Earnings keep rolling in: Netflix (NFLX) shares surged nearly 10% after the company reported strong quarterly earnings and issued a rosy outlook.

Delta (DAL) shares also jumped in premarket trading after the airline reported quarterly profit growth, compared to the year-ago quarter.

DuPont (DD) reported slightly better quarterly earnings, boosted by a lower tax rate and growth in certain areas of business including electronics and communications.

Coach (COH) posted earnings and sales that missed forecasts, led by a drop in domestic sales. The one bright spot was China, where sales jumped 35%.

Lockheed Martin (LMT) shares rose after the aircraft manufacturer reported a jump in quarterly profit, year over year, and increased its full-year outlook.

Tablet-palooza: Apple (AAPL) will be in the spotlight in the afternoon, when it hosts an event at which it is expected to unveil a new version of the iPad.

Nokia (NOK), which is being bought by Microsoft (MSFT), earlier Tuesday unveiled its first full-size tablet and a pair of big-screen colorful Lumia smartphones.

Related: $300 million price tag for Obamacare site

Global markets were relatively subdued Tuesday. European markets diverged, with U.K. stocks edging up, while indexes in France and Germany slipped. Asian markets were also mixed, with stocks in Hong Kong falling after a weak earnings report from heavyweight China Mobile, while Japan inched higher.