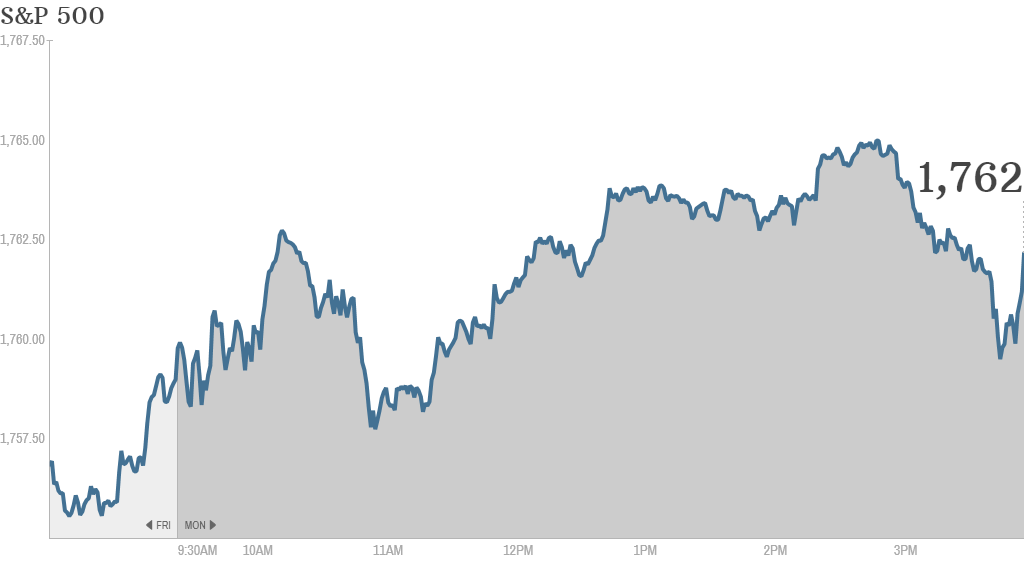

The S&P 500 ended at another record Monday. But it wasn't exactly a big rally.

The S&P 500 rose 2 points to surpass Friday's all-time high. The Dow Jones industrial average and the Nasdaq both fell slightly.

It was a relatively slow day on Wall Street. But investors have been pleased by the latest batch of corporate earnings. About half of the companies in the S&P 500 have reported their third quarter results, and 75% of them were better than expected, according to FactSet.

Still, profit growth has been sluggish. So far, overall earnings have increased a mere 2.3%, led by companies in the consumer discretionary sector.

After the closing bell, Apple (AAPL) reported sales and earnings that topped forecasts. But the stock fell after hours as investors appeared to focus more on falling profit margins.

Related: CNNMoney's Fear and Greed Index continues to show greed

Also after the bell, Herbalife (HLF) announced earnings and sales that beat analysts' expectations. Shares of the nutritional products maker were flat in extended trading.

Earlier, Merck (MRK) shares fell after the drugmaker reported sales that missed forecasts. Burger King (BKW) surged after the fast food chain reported earnings and revenue that topped forecasts.

Where's the momentum? Meanwhile, shares of several high-flying technology stocks were under pressure.

"Anyone think there is a shift out of momo stocks in general going on right now," said gwynn19. "Seems they all have been getting hit lately."

Shares of Netflix (NFLX), which reported strong results last week, were down nearly 4%. Tesla (TSLA) shares also slid. The electric car maker's stock has more than tripled in price this year.

Facebook (FB) was under pressure ahead of the company's third-quarter report Wednesday. The stock has been on a tear since the social network surprised investors in July with strong results in mobile advertising.

"$FB why is it down so much today. i guess people want to protect their profit," said bebeyuk.

Shares of J.C. Penney (JCP) jumped 8% following reports that CEO Myron Ullman reiterated his view that sales trends are improving. The retailer's stock has plunged recently amid rumors about a potential bankruptcy and credit crunch.

"$JCP . . . Ullman will end up being revered as next great turnaround CEO," said sister.

Related: This could be Fed's largest stimulus yet

Fed on deck. Stocks have also found recent support on hopes of continued stimulus from the Federal Reserve.

The Fed has a policy meeting this week and is widely expected to say it will continue buying $85 billion in bonds and mortgage-backed securities a month.

Investors had expected the Fed to cut back, or taper, its bond buying this year. But the government shutdown may have caused economic damage and uncertainty that will keep the Fed from pulling back on stimulus just yet.

Steven Ricchiuto, chief U.S. economist at Mizuho Securities, expects the Fed to delay tapering until the middle of 2014, "at the earliest."

Related: Bond rates unlikely to soar again

John Stoltzfus, chief market strategist at Oppenheimer, said stocks have also been powered by genuine improvement in economic "fundamentals," pointing to strong auto sales and a recovery in housing, among other things.

Stoltzfus expects stocks to move higher in the long term as the economy expands and investors shift money out of safe havens like bonds and into more risky assets. But with many stock prices at all-time highs and the threat of additional political risk on the horizon, "don't be surprised if we experience some choppiness ahead," he added.