It seems like the price of things goes in one direction only: up.

It's true that sticker prices usually rise. But in relative terms, you could actually be paying a lot less than your parents did a generation ago.

For example, the price of milk has increased at a pace that's 9% slower than the overall level of inflation since 1983, according to the Bureau of Labor Statistics.

Meanwhile, some other things will cost you a lot more than the previous generation paid. Since 1983, a gallon of gas has risen 30% relative to everything else.

So what things do you pay relatively more for now than your parents did, and what things cost relatively less?

"Stuff" is getting cheaper

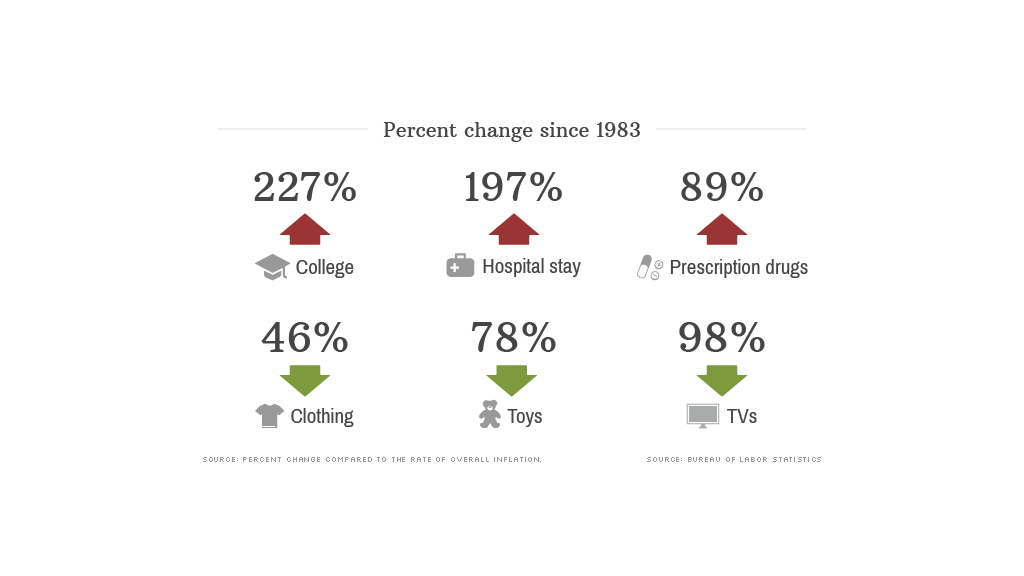

The price of manufactured goods is way down. Televisions are now 98% cheaper than they were in 1983, according to the Consumer Price Index.

The index accounts for advances in technology. That 98% drop means a TV that costs $100 in 1983 -- with its dial controls and antenna -- would be worth about $2 today.

Toys are another example. The price of toys has fallen 78% compared to the overall level of inflation in the last 30 years. And clothing has fallen by 46%.

"We've experienced the 'miracle of manufacturing' over the last 50-60 years," said Mark Perry, an economist at the University of Michigan Flint School of Business. "Anything that is manufactured has become cheaper and cheaper over time."

Quiz: Cheaper or more expensive?

It's easy to attribute the decline in price for manufactured goods to outsourcing and rise of China's economy, but that's only part of the story.

Other advances in manufacturing include better supply chain management and, especially, automation. The manufacturing sector is currently going through what agriculture went through at the beginning of the last century. At the time, tractors and harvesters replaced human labor on the farms, vastly increasing the amount of food that could be produced and sharply lowering food prices.

The average family now spends less than 20% of their income on food and manufactured goods, according to Perry. That's down from over 40% in the late 1940s.

Perry expects these advances to continue, citing the advent of 3D printing and other technologies, and said the quality of manufactured goods should continue rising while the prices fall even further.

Services are getting pricier

What hasn't experienced a full on revolution is the services economy. As such, prices for services and specialty goods have soared.

The cost of college tuition has surged 227% over the rate of inflation since 1983, according to BLS. A hospital stay is up 197%, while prescription drugs are 89% more expensive. And housing costs are more expensive too -- up 14% from 1983.

What's happened is the demand for these things has grown substantially as people got richer, said Douglas Irwin, an economics professor at Dartmouth College. But advances in productivity -- the ability to churn out ever greater numbers for a cheaper price -- hasn't kept up.

It's possible that as the labor force moves from the factory floor to what Google Chairman Eric Schmidt calls the "creative and caring economy," there could be big gains in productivity, but economists have a hard time seeing it.

"It's hard to shift the supply curve," said Irwin. It's just not that easy to automate a college lecture, or a yoga class, or a visit to the doctor.