Optimism washed over investors Wednesday on expectations that the Federal Reserve will maintain its massive stimulus efforts.

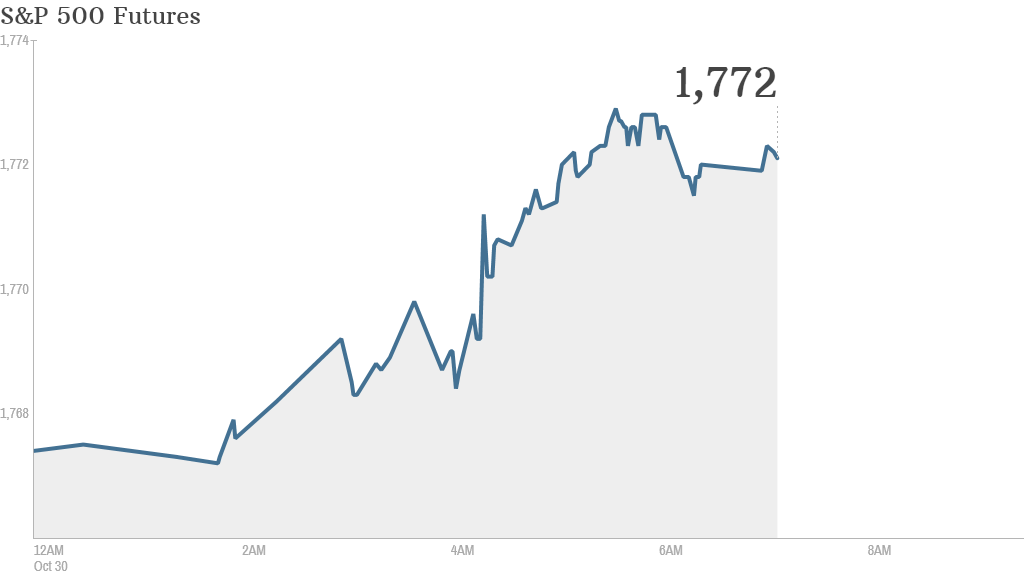

U.S. stock futures rose, as European markets climbed to their highest levels in five years. The Fed is due to release a statement at 2 p.m. ET, following a two-day policy meeting.

Investors will parse the text for clues about when the central bank may begin scaling back its $85 billion monthly bond buying program. Many expect current stimulus efforts will be maintained for the remainder of the year.

The stimulus measures have helped buoy global markets - with the Dow Jones Industrial Average and S&P 500 trading at record highs.

Related: Fear & Greed Index surges to extreme greed

Elsewhere on the economic front, payroll processor ADP releases its monthly report on private-sector job growth at 8:15 a.m. ET. The Bureau of Labor Statistics issues the September edition of the Consumer Price Index, the government's key metric for inflation, at 8.30 a.m. ET.

Earnings season continues in full swing: Sprint (S) reported a quarterly profit, after slogging through losses in earlier quarters, while Comcast (CMCSA) reported declines in quarterly sales and profit.

General Motors (GM) reported improved operating income and revenue as it narrowed losses in Europe and improve its profit margin in North America. Chrysler reported double-digit gains in profit and sales for the quarter. The automaker is not publicly traded, but has announced plans for an initial public offering.

Yelp (YELP) shares plunged 10% after the review site reported a wider-than expected quarterly loss and announced plans for a follow-on stock offering. On the flip side, Baidu (BIDU) shares rallied after China's largest search engine posted strong earnings and sales, and said earnings in the current quarter would easily top forecasts.

Related: Amazon is one of the most overvalued stocks

Shares of Electronic Arts (EA) jumped about 8% after the video game maker's quarterly earnings beat expectations.

Facebook (FB), Expedia (EXPE) and Visa (V) will report after the market close.

The Dow and S&P 500 closed at record highs Tuesday.

Meanwhile, Asian markets ended with sizable gains, with Hong Kong's Hang Seng climbing 2% and the Shanghai Composite index up 1.5%. A weaker yen helped push Japan's Nikkei up 1.2%.