Stocks remain near record highs as investors take comfort in Federal Reserve nominee Janet Yellen's pitch to support the U.S. economic recovery.

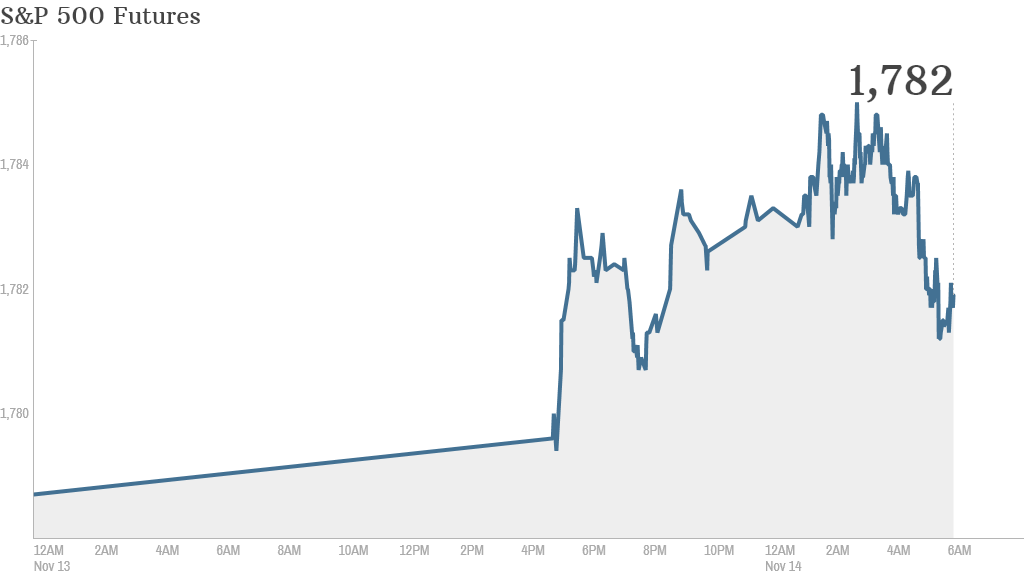

U.S. stock futures were little changed Thursday, with the S&P 500 and Dow Jones Industrial Average on track to open at new records.

Yellen -- who is expected to become the new head of the Fed in early 2014 -- will appear before the Senate Banking Committee at 10 a.m. ET.

Her prepared remarks to the committee, released late Wednesday, show that she intends to encourage growth by maintaining accommodative monetary policies.

"Part of the rally we saw yesterday (and this morning) was partly driven by relief that Yellen is not about to take on a substantially less-dovish tone in today's testimony in an effort to garner the support of the more hawkish elements of the Senate Banking Committee," wrote Deutsche Bank analyst Jim Reid in a market report.

The comments gave market participants hope that Yellen would continue the Fed's current $85-billion-per-month bond-buying program for the next few months. The program -- also known as quantitative easing or 'QE' -- has helped spur stocks by pumping markets with extra cash.

Related: Fear & Greed Index, still greedy

Investors are also waiting for the U.S. to release its weekly report on initial jobless claims at 8:30 a.m. ET, as well as monthly data on the trade balance.

In earnings news, Wal-Mart (WMT) reported better-than-expected earnings, though the retailer missed on revenue and reported a slight decline in same-store sales in the U.S.

Viacom (VIA) reported a gain in quarterly revenue, driven by sales in media networks and filmed entertainment, and double-digit gains in net earnings.

Shares in Cisco (CSCO) sank by roughly 11% in premarket trading, a day after the tech giant reported weak quarterly sales and guidance.

Related: Japan's economy slows dramatically

European markets rose modestly in morning trading. Data out Thursday showed the eurozone grew by 0.1% in the third quarter, in line with economists' expectations.

Asian markets ended the day with gains. A weaker yen helped Japan's Nikkei jump 2.1%. The currency eased after official figures showed the country's economy grew 1.9% in the third quarter - a sharp slowdown from the previous quarter.