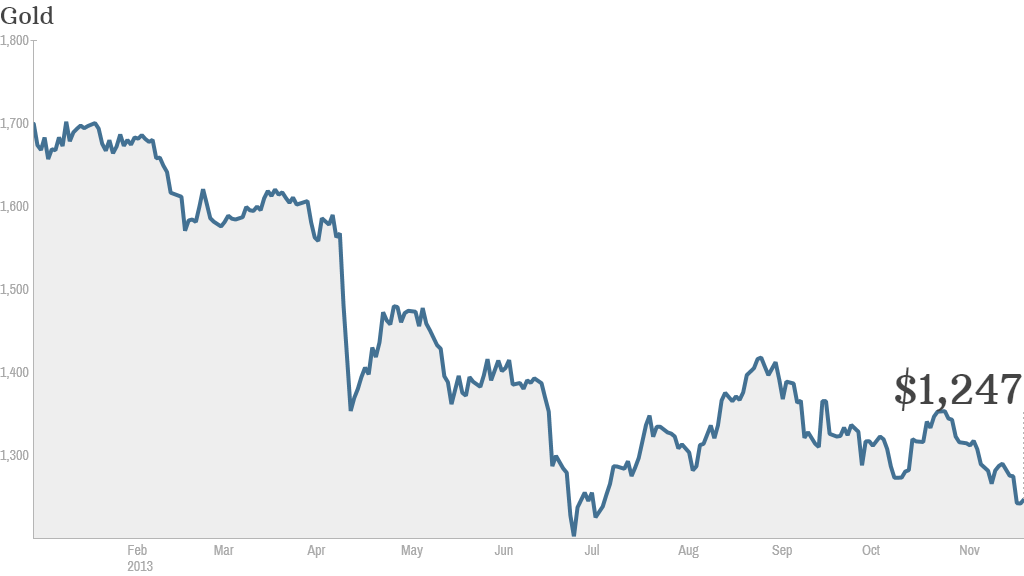

Gold prices have tumbled this month and are back near their lowest levels of the year.

The precious metal is trading at about $1,245 an ounce, down 25% from the beginning of 2013. Gold dipped as low as $1,211 an ounce in June.

Gold has been under pressure since the European Central Bank announced a surprise interest rate cut earlier this month, said Carlos Sanchez, analyst at precious metals firm CPM Group.

That drove up the value of the dollar versus the euro and made dollar-denominated assets, such as gold, less attractive.

The selling accelerated Wednesday after minutes from the latest meeting of the Federal Reserve raised speculation that the central bank could scale back, or taper, its bond-buying program, known as quantitative easing, as soon as December.

But gold prices managed to hold above $1,240 an ounce, which is an important support level for technical traders, said Sanchez.

"I think we're at the lows," he said. "This is a good buying opportunity for mid to long-term investors."

Sanchez said the economy is not yet strong enough for the Fed to begin tapering next month.

Related: China becomes world's top gold buyer

What's more, Sanchez said the central bank could "offset" the impact of tapering by signaling that short-term interest rates will remain exceptionally low for longer by reducing its target for unemployment.

"While tapering will occur, the Fed doesn't want to do it in a way that causes interest rates to spike higher," he said.

Gold has been punished this year as investors pulled money out of safe havens to chase higher returns in the stock market. Stocks have soared to record highs in the latest phase of a nearly five year-old bull market.

"The race up in equity markets has some institutional investors wondering why they should hold gold when Wall Street is booming," said Jeff Nichols, managing director of American Precious Metals Advisors.

Nichols said the selling was exaggerated as prices fell through key technical levels that triggered "program trading" in gold futures and gold-backed exchange-traded funds such as the popular SPDR Gold Shares (GLD) fund.

Gold demand in India, historically a large consumer of gold jewelry at this time of year, has been "disappointing" as the government imposes import restrictions, Nichols added.

Related: $1.2M gold haul found on plane in India

Gold 2.0? As gold prices slide, investors have been piling into the market for Bitcoin. The virtual currency has been called "Gold 2.0" by those who see Bitcoin as an alternative to the precious metal.

Axel Merk, founder of Merk Investments, a firm that specializes in currencies and precious metals, said Bitcoin has potential as a "medium of exchange" but not as a long-term holding.

"Bitcoin is technology driven, and we don't know how the technology is going to evolve," he said. "If you want to save something for 50 years, would you rather have it in gold or Bitcoin?"

But James Rickards, senior managing director at Tangent Capital Partners, said there's no correlation between the drop in gold prices and the rise in Bitcoin.

Related: Bitcoin's tipping point

Rickards said the gold market is large and liquid, while the Bitcoin market is still small, difficult to access and very volatile. Bitcoin also appeals to a different class of investor, he added.

"People who like Bitcoin are technophiles, they're not financial people," he said.

Peter Schiff, market strategist at Euro Pacific Capital, said Bitcoin lacks the "intrinsic value of gold." He added that he thinks Bitcoin is destined to fail once early adopters decide to cash in and the market collapses.

"It's Tulip Mania 2.0, not Gold 2.0," he said.

That may be true. But then again, you could argue that gold is a bubble that has already popped. It is trading more than 35% below its 2011 all-time high of more than $1,900 an ounce after all.