Markets are beginning December in a cautious mood as investors wait for economic news later this week and reflect on a weak start to the festive shopping season.

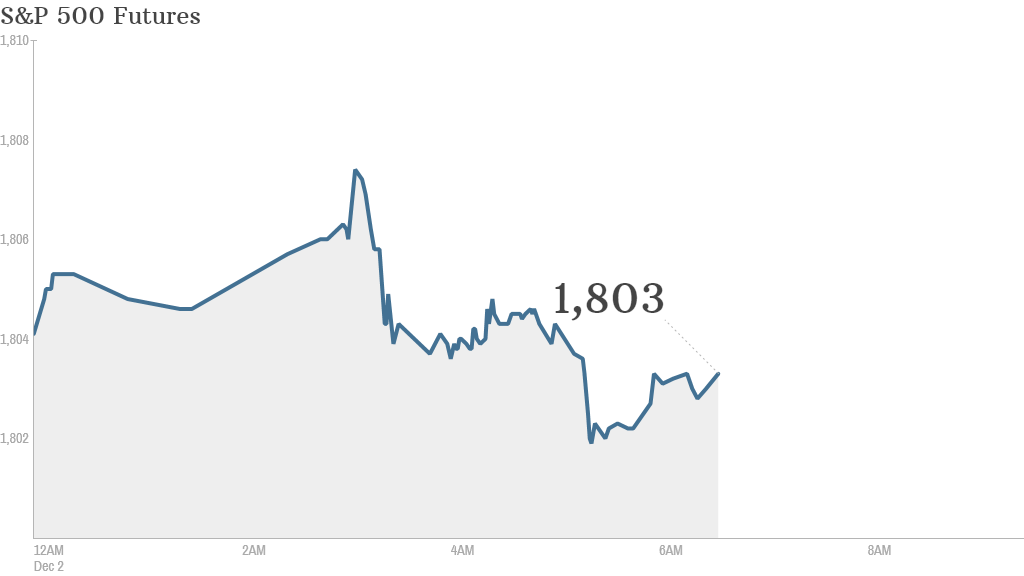

U.S. stock futures were little changed ahead of the opening bell, while world markets were mixed despite encouraging manufacturing data from China and Europe.

After an underwhelming Black Friday, investors will be watching Cyber Monday shopping figures for further clues as to the health of the U.S. consumer. The National Retail Federation reported that shoppers spent an average of 4% less over the holiday weekend, the first decline in spending since 2009.

Related: Bulls look for new market highs

At 10 a.m. ET, the Census Bureau will release data on construction spending, while the Institute for Supply Management will release its monthly manufacturing index .

Those reports will kick off "a bumper week of U.S. data over the next five days, in part making up for two days of blackout last week for Thanksgiving," said Deutsche Bank analyst Jim Reid

The November jobs report is due Friday and that could give investors a better sense of how much longer the Federal Reserve will maintain its massive stimulus program at current levels.

Other reports this week include auto sales, non-manufacturing ISM, the second estimate of third quarter GDP and weekly jobless claims.

In corporate news, doughnut maker Krispy Kreme (KKD) is scheduled to report quarterly results after the closing bell.

Related: Fear & Greed Index, extreme greed

U.S. stocks finished a strong November Friday on a trading day that was shortened for the holiday weekend.

European markets were weak in morning trading, despite surveys showing manufacturing activity at its highest level since June 2011.

Asian markets ended mixed after manufacturing data out of China exceeded analyst expectations and state regulators signaled they would soon lift a moratorium on IPOs. The Hang Seng gained 1%, while the Shanghai Composite closed down 0.5% as investors eyed the opportunity to move cash into new listings.

The Nikkei was flat as markets shrugged off the latest confrontation between Beijing and Tokyo over a set of contested islands in the East China Sea.