Investors seem to be taking a breather after Wednesday's Federal Reserve-inspired gains.

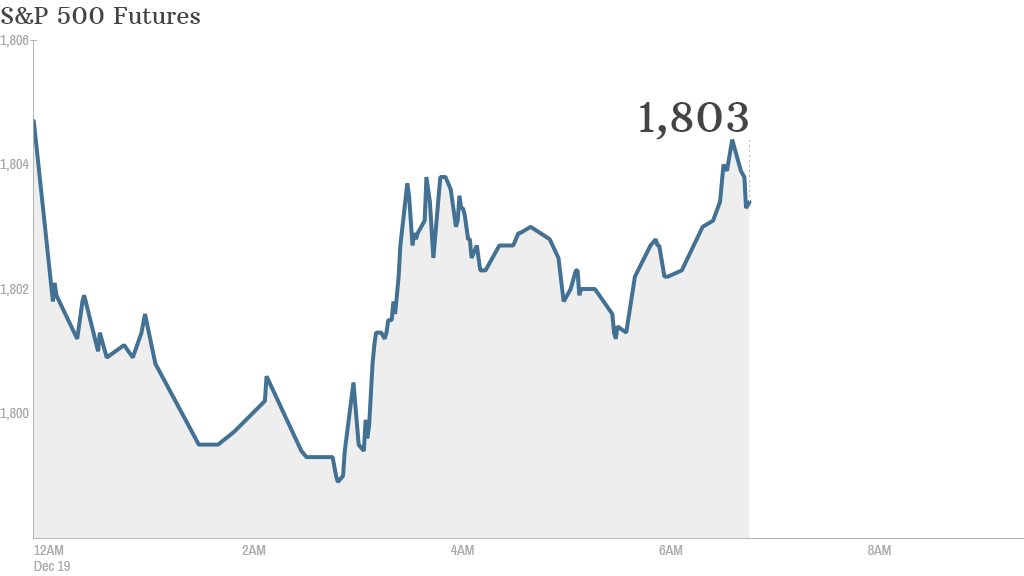

U.S. stock futures showed little movement Thursday morning ahead of the opening bell, aside from slight queasiness.

U.S. stocks surged Wednesday after the Federal Reserve announced a modest scaling back of its stimulus program. The program was launched in September 2012 and involved pumping $85 billion per month into the markets through bond purchases.

Beginning in January, the Fed said it will scale the purchases back to $75 billion per month.

The Fed's decision to wind down -- or taper -- its stimulus program can be interpreted as a sign the economy is getting back on its feet and no longer needs as much assistance from the central bank.

Related: Federal Reserve finally tapers its stimulus

The Dow Jones industrial average jumped more than 290 points after the announcement, closing at an all-time high. The S&P 500 and the Nasdaq also moved substantially higher, with the S&P closing at a record.

The Fed has been buying bonds since 2008 and many investors say the liquidity boost has helped drive global stock markets higher.

Looking ahead to Thursday, the U.S. government will release its weekly report on initial jobless claims at 8:30 a.m. ET. At 10:00, the National Association of Realtors will issue its monthly report on existing home sales and the Philadelphia branch of the Federal Reserve will release its monthly manufacturing survey.

In corporate news, Facebook (FB) shares took a dive in premarket trading after the social media company filed to sell 70 million shares of Class A common stock. That includes more than 41 million shares from co-founder and CEO Mark Zuckerberg.

Firms including Carnival (CCL), KB Home (KBH) and Rite Aid (RAD) are scheduled to report quarterly results before the opening bell, while Nike is up in the afternoon.

Darden Restaurants (DRI) missed on earnings, as its quarterly diluted net profit plunged year-to-year. The company announced plans to spin off the Red Lobster chain, which experienced a slump in sales.

Related: IPO market expected to stay hot in 2014

Looking at equity markets around the world, European markets were playing catch-up with the U.S. in morning trading. Most major European indexes were rising by roughly 1.5%.

Asian markets ended with mixed results. Japan's Nikkei surged 1.7% to close at a six-year high, while Australia's ASX All Ordinaries index jumped 2%. But the main Chinese indexes dipped down by roughly 1%.