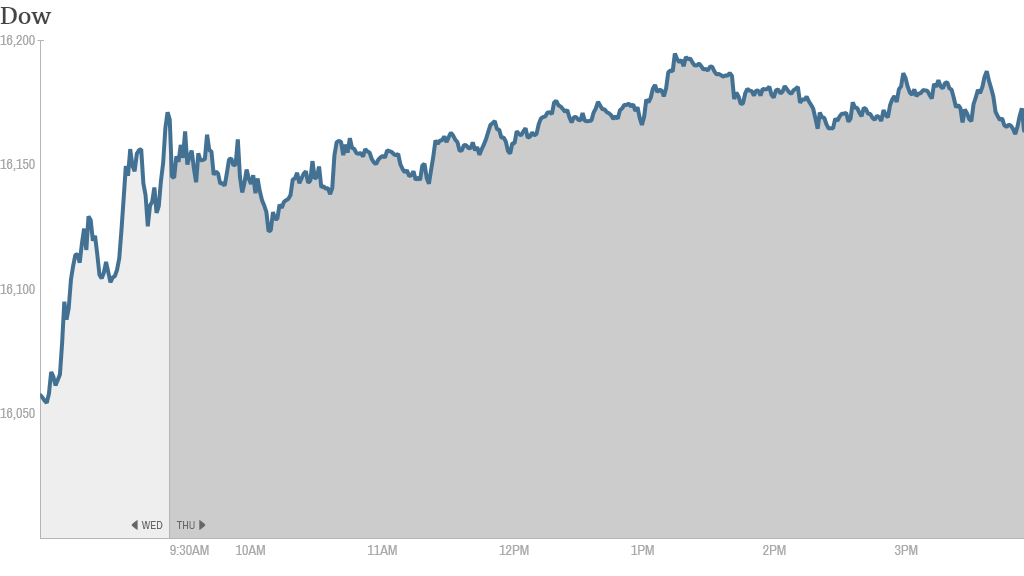

Investors took a breather Thursday following the huge Fed-inspired rally Wednesday.

After ending at record closing highs the previous day, the Dow and the S&P 500 finished the day mostly unchanged. The Nasdaq slipped slightly.

All three indexes surged more than 1% after the Federal Reserve announced a modest scaling back of its stimulus program. Instead of pumping $85 billion per month into the markets through bond purchases, the Fed said it will scale the purchases back to $75 billion per month beginning in January.

Related: Federal Reserve finally tapers its stimulus

The Fed's decision to wind down -- or taper -- its stimulus program can be interpreted as a sign the economy is getting back on its feet and no longer needs as much assistance from the central bank.

That pleased investors all around, as the change isn't so drastic to start. But it also may satisfy Fed critics who believe the central bank would be in danger of creating runaway inflation if it did not begin to cut back on the accommodative polices that it instituted in response to the financial crisis.

Related: CNNMoney Fear and Greed Index moves out of Fear mode

Despite Wednesday's big gains, December has so far been a dud for the stock market. All three indexes are flat for the month. But a so-called Santa Claus rally still has time to transpire, especially now that investors have a lot more clarity from the Fed.

But even without any huge gains, 2013 has been a stellar year for stocks. The Dow and S&P 500 are up more than 20% for the year, while the Nasdaq has surged more than 30%.

Those gains put the Dow on track for its best year since 2003 and the S&P 500 on pace for its best year since 1997. The Nasdaq's gains would be the index's best since 2009.

Related: Fortune 500: Worst-performing stocks of 2013

Gold prices tumbled more than 3% and traders blamed the Fed's taper decision. Prices fell below $1,200 an ounce for the first time in over three years. The Gold ETF (GLD) and gold miners including Newmont Mining (NEM) were taking a hit. The sharp drop generated plenty of buzz on StockTwits.

"$GLD Yup, agreed, $1200's are history...." Stockswinger1968. "Miners are tanking hard...should see $1,050 - $1,100 in Q1 2014...I'd like to see an $800 bottom."

StockTwits user tradewithjoe added that investors still buying gold "now should just donate money to charity. Fed crushed gold prices yesterday. End of story. $GLD."

But a handful of investors remained optimistic, suggesting that gold could again offer some safe haven appeal if Congress bickers over the debt ceiling early next year.

"$GLD Not a single fundamental reason to sell GOLD, NONE," said skyzer. "Printing $75B instead $85B? What else? Debt Ceiling Increase or default in 1 month."

In corporate news, Darden Restaurants (DRI) missed on earnings. The company also announced plans to spin off the Red Lobster chain, which experienced a slump in sales.

Target (TGT)shares fell more than 2% after the retailer said that as many as 40 million people who shopped at Target stores in the three weeks after Thanksgiving may be affected by a breach of credit and debit card data.

Though it remains to be seen how the breach will impact how consumers feel about shopping at Target in the future, one StockTwits trader mentioned that the timing of the breach is particularly unfortunate, given that the holidays are key for retailers.

"$TGT data breach news awful timing so close to Christmas, Bearish," said quantitude.

Related: IPO market expected to stay hot in 2014

Facebook (FB) fell after the social media company filed to sell 70 million shares, mostly to index funds that will be buying the stock once it is added to the S&P 500. That includes more than 41 million shares from co-founder and CEO Mark Zuckerberg.

Despite the move downward, StockTwits traders remained bullish on Facebook, which is up more than 100% so far in 2013.

"$FB Go take a nap," said bopdubop. "We'll see you tomorrow. You need some rest. Bullish."

Another trader suggested the pullback may be a good buying opportunity, highlighting that Facebook is slated to be added to the S&P 500 at the end of trading this week, an event that will help further expand the stock's investor base.

"$FB Buy the dip," said explorestocks. "With S&P inclusion tomorrow, there will be a big rally and demand. Bullish."

Looking at stocks around the world, European markets rose by roughly 1.5% in their first opportunity to react to the Fed tapering news. Asian markets ended mixed.