With only a few trading days left in 2013, investors who are hoping the Santa Claus rally will continue Friday may be disappointed.

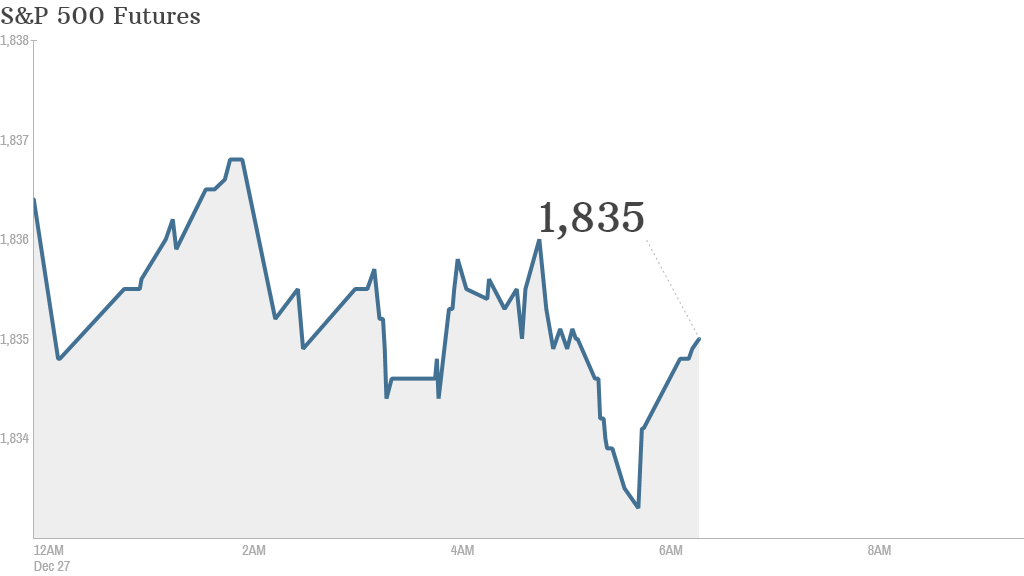

U.S. stock futures were weak, with the S&P 500 down 0.1%, pointing to a mostly softer start to trade as the Dow eked out nearly imperceptible gains.

On Thursday, the Dow Jones industrial average closed at a record high for the 50th time this year. The S&P 500 also ended at a record high, and the tech-heavy Nasdaq marked a new 13-year high.

Dubbed the "Santa Claus rally," stocks often surge in the week between Christmas and New Year.

But Joe Tatusko, chief investment officer for Westport Resources, a financial planning firm in Connecticut, said that futures were slipping on Friday because many individuals are selling stocks to reduce their tax bills.

"It's a darn good time to do some tax loss selling," he said.

Related: Fear & Greed Index gets greedy

Markets have charted big gains this year. The Dow and S&P 500 are both up more than 20%, while the Nasdaq has soared over 30%.

The Dow is on track for its best year since 2003 and the S&P 500 on pace for its strongest year since 1997.

Several factors have helped spur gains this year including ongoing economic stimulus from the Federal Reserve, increased confidence in the economy and solid corporate earnings growth.

Related: Best year ever for stock funds

Earlier this month the Fed announced that it will modestly reduce its bond buying program in January. But many experts believe the bull market will continue for a sixth year in 2014, albeit at a more modest pace.

European markets rose in morning trading, led by a 0.7% rise on Germany's DAX. London's FTSE gained 0.5% and France's CAC 40 put on 0.6%.

Asian markets ended the week on a positive note. China's Shanghai Composite rose 1.4% and Hong Kong's Hang Seng Index added 0.3%.