Stocks look set for another cautious session Thursday, with central bank policy and the economy in the spotlight.

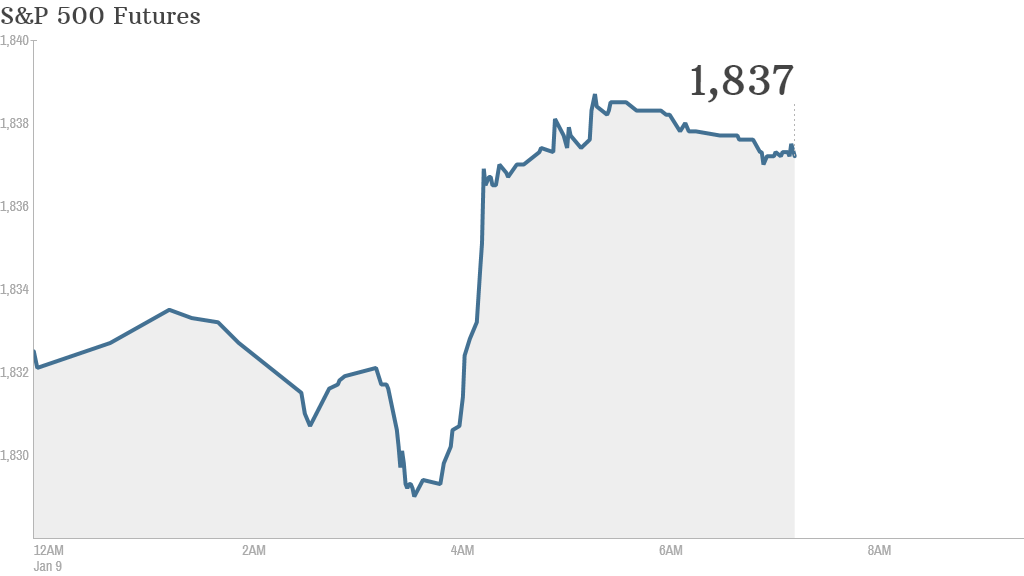

U.S. stock futures were modestly higher ahead of the market open.

A day after the Federal Reserve released minutes saying it would proceed cautiously in scaling back its massive monetary stimulus, investors will get another update on the health of the U.S. economy with the government's weekly report on initial jobless claims at 8.30 a.m. ET.

Fed bond buying helped drive the record-setting stock run-up in 2013, and markets have begun this year in a reflective mood.

"With plans to reduce extraordinary stimulus having been taken as a sign of economic recovery, market optimism may now itself need tapering given the Fed caution," said Mike van Dulken, head of research at Accendo Markets.

The weekly initial unemployment claims report comes one day before the government's monthly jobs report for December.

Hopes for another strong rise in employment were raised Wednesday when payroll processor ADP reported that businesses added 238,000 workers in the month.

Economists surveyed by CNNMoney predict the report will show 193,000 jobs were added in December, consistent with a story of solid hiring in the last four months of 2013. The unemployment rate is expected to remain at 7%.

European markets were mixed in morning trading. The Bank of England left rates unchanged and maintained its stimulus program. The European Central Bank also left rates unchanged. ECB President Mario Draghi will hold a press conference at 8:30 a.m. ET to discuss the state of the European economy.

Related: Fear & Greed Index, still greedy

On the corporate front, Family Dollar (FDO) shares plunged in premarket trading after the budget retailer missed estimates on sales and profit, reported a drop in same-store sales, and lowered its guidance for the year.

Shares rose for Costco (COST) after it reported an increase in same-store sales.

Aluminum producer Alcoa (AA) is up in the afternoon.

Macy's (M) shares surged after the department store operator revealed cost-cutting plans late Wednesday that included laying off of 2,500 workers and closing five stores. The retailer maintained its financial forecasts.

Bed Bath & Beyond (BBBY) shares tumbled after the retailer reported quarterly earnings that missed estimates.

Aluminum producer Alcoa (AA) reports results after the bell.

Related: Investors bet big on big banks

U.S. stocks finished mixed Wednesday. Stocks have been relatively soft since the start of the year.

Most major Asian markets posted losses Thursday.

The Nikkei in Japan dropped by 1.5%. The index surged by 56.7% in 2013 -- its biggest annual rise in over 40 years.