Quarterly results and volatility in emerging markets could set the tone for trading in U.S. markets Tuesday.

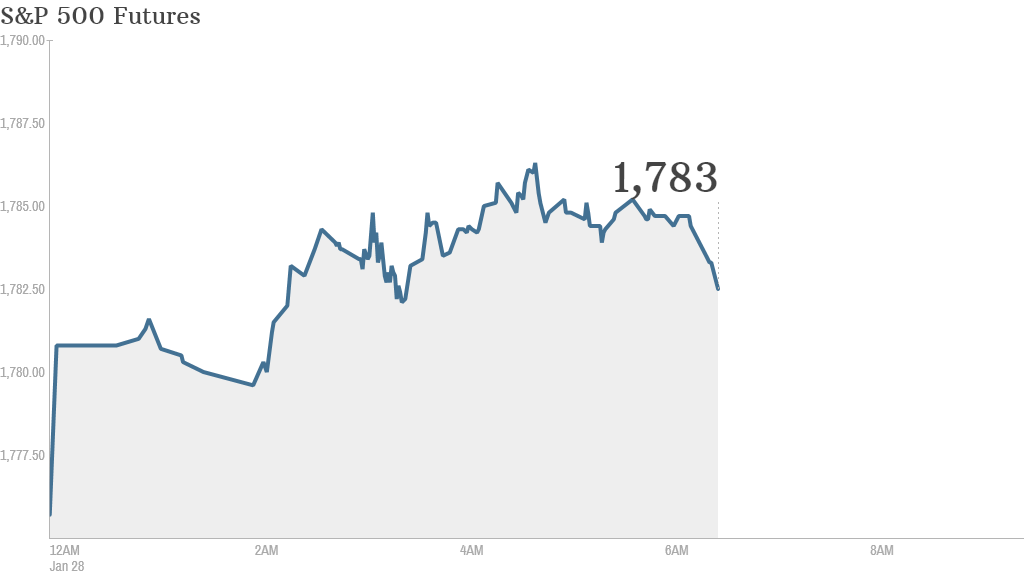

U.S. stock futures were mixed ahead of the open. Tech shares could come under pressure from Apple (AAPL), which reported weaker-than-expected fourth quarter iPhone sales late Monday.

But the Dow was pointing to a positive start, helped by solid earnings from Pfizer (PFE), which reported better-than-expected earnings, though sales fell short of estimates.

Earnings season is in full swing: Ford (F) shares rose after the automaker reported better-than-expected quarterly earnings that matched last year's results.

Comcast (CCV) reported a jump in quarterly sales and earnings.

DuPont (DD) reported a jump in quarterly sales and operating earnings, propelled by insecticide sales in Latin America as well as earlier seed shipments. The company also announced a $5 billion share buyback.

After the close, results are due from Yahoo (YHOO), AT&T (T) and Electronic Arts (EA).

Related: Fear & Greed Index swallowed by extreme fear

Emerging markets have returned center stage over the past few days as protests and wild currency fluctuations led to a sweeping sell-off.

Early Tuesday, Ukraine's prime minister offered to resign in a bid to ease a political crisis in his country.

Turkey's central bank is set to hold an emergency meeting Tuesday in an effort to halt the lira's steep decline. And India surprised investors with a rate hike to combat rising prices.

Related: Is this an emerging markets crisis?

The turmoil has been sparked, in part, by the U.S. Federal Reserve's plans to reign in the flow of cheap money. The markets expect the Fed to announce a further cut to its bond-buying program Wednesday, which could prompt a withdrawal of cash from vulnerable emerging markets.

"With all this [turmoil] in the background and ahead of tomorrow's Fed policy meeting in which most in the market now expect a further reduction of the bond-buying program by $10 billion, it's a no-brainer that asset allocators around the world are shedding their emerging market holdings," said Ishaq Siddiqi, a market strategist at ETX Capital in London.

In economic news, the U.S. Census Bureau is set to release its monthly report on durable goods orders at 8:30 a.m. ET. The Case-Shiller 20-city home price index is due at 9 a.m. ET, while the Conference Board's Consumer Confidence Index comes out at 10 a.m. ET.

President Obama will give his annual State of the Union message at 9 p.m. ET.

European markets edged higher in early trading while Asian markets ended mixed.

U.S. stocks fell Monday for a fifth consecutive day, continuing the slide from the previous week.