Investors are hoping corporate earnings and economic data will help stocks bounce back Thursday after recent sharp losses.

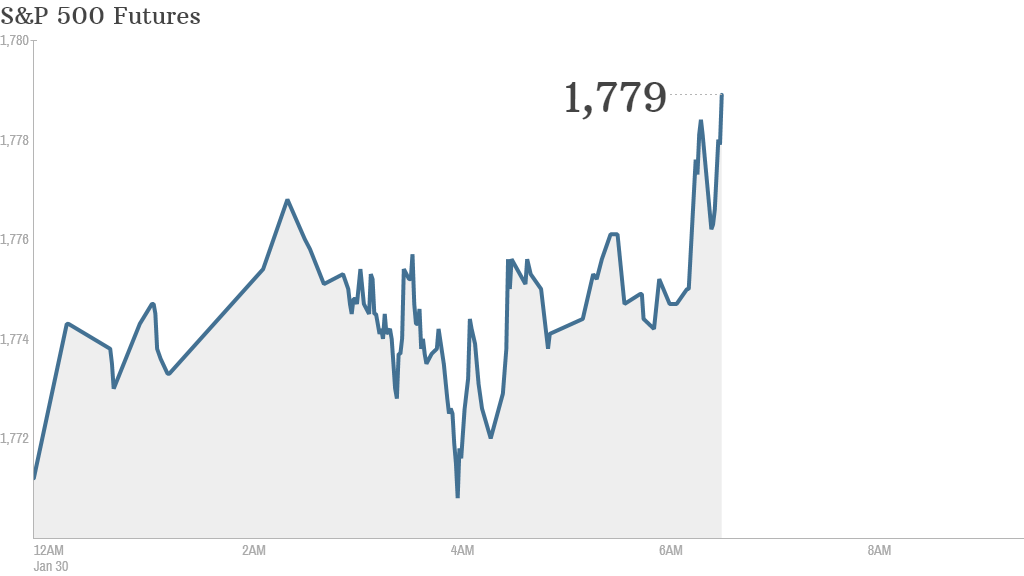

U.S. stock futures were edging slightly higher ahead of the opening bell, though global markets were predominantly in the red.

Investors are watching international developments closely, after a reduced flow of cheap money from the Federal Reserve accelerated a sell-off in some emerging market currencies.

U.S. stocks fell more than 1% Wednesday after the Fed said it was cutting another $10 billion per month from its economic stimulus program. Investors were disappointed the central bank didn't address the recent turmoil in emerging markets.

The turmoil has prompted a flight from riskier assets, including stocks.

The Dow Jones industrial average has fallen on six out of the last seven trading days and is down 5% so far this year. The S&P 500 index has dropped by 4% since the start of 2014, with the bulk of the losses sustained over the past few days.

Related: Fear & Greed Index slides back into extreme fear

Investors will get their first reading of U.S. fourth-quarter GDP from the Commerce Department Thursday at 8:30 a.m. ET. Briefing.com's consensus forecast is calling for annual growth of 3% for the broadest measure of the economy.

Also at 8:30, the government will release its weekly report on initial jobless claims.

Beyond economic data, it's another day chock full of earnings reports.

"Today is one of the busiest days on the corporate reporting calendar with 10% of the S&P 500 provid[ing] earnings updates, including Exxon Mobile and Google which are the second and third largest companies by market cap," Deutsche Bank analyst Jim Reid wrote in a market note.

UPS (UPS) and Exxon Mobil (XOM) are on deck to report ahead of the opening bell, while. Amazon (AMZN) and Google (GOOG) are set to report in the afternoon.

There have been some bright spots. Facebook (FB) shares surged more than 13% in premarket trading following strong quarterly sales and earnings results.

Google shares also rose after the company announced it was selling its Motorola Mobility smartphone business to China's Lenovo for $2.9 billion.

Related: Asia stocks battered by emerging market fears

European markets were in negative territory in morning trading, and Asian markets also took a knock.

Japan's Nikkei dropped 2.5%, while Hong Kong's Hang Seng shed 0.5% and Australia ASX All Ordinaries lost 0.8%. The Shanghai Composite, which often diverges from other Asian markets, advanced 0.6%.

The HSBC report on Chinese manufacturing showed a retraction, coming in at 49.5 for January, down slightly from the flash reading of 49.6. Any reading below 50 signals contraction.