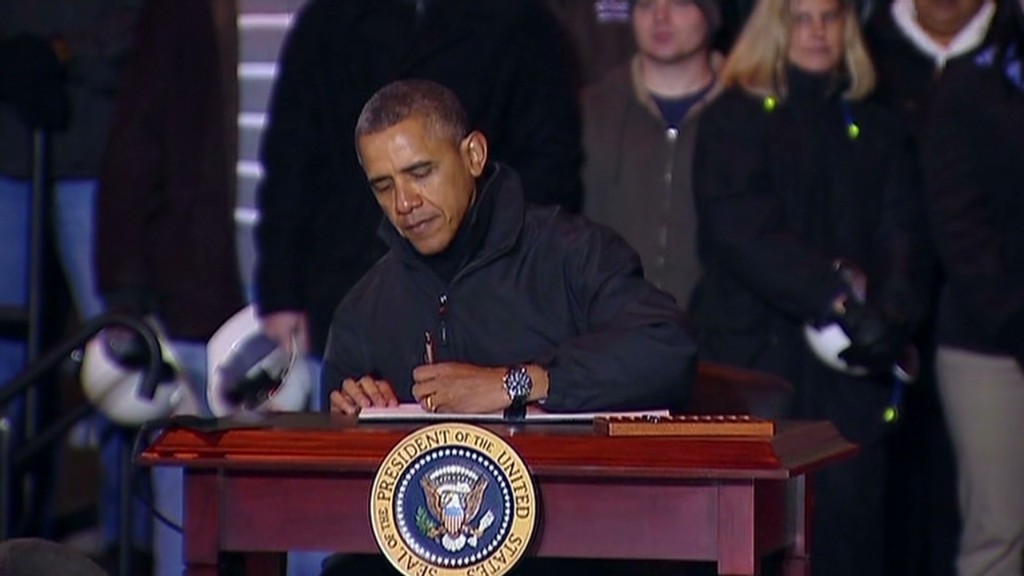

Obama's new 'myRA' retirement accounts aim to help millions of workers begin saving for retirement. The accounts will be backed by the government, charge no fees and you'll be able to contribute directly from each paycheck.

But not everyone thinks the new plans are a great deal. The accounts, which will launch in a pilot program later this year and will eventually be available to any worker who gets paid through direct deposit and earns below a certain threshold, has elicited a wide range of reaction.

CNNMoney heard from dozens of readers about the president's plan. From disbelievers to eager savers, here's a sampling of where America stands on myRAs:

"Why would anyone consider giving a broke and bankrupt government any more of your money? That's foolish," said 62-year-old reader Steve Keller.

Related: What you need to know about Obama's 'myRA' retirement accounts

Yet, people from a range of ages and financial situations expressed enthusiasm for myRA, saying they would sign up immediately if able. Some don't have access to workplace savings plan, while others said they like the idea of supplementing their savings with the account, which would allow them to save up to $5,500 a year until the account balance reaches $15,000.

In previous years, 36-year-old Grand Prairie, Texas resident Angel Malone had both retirement and other savings set aside. But after weathering four months of unemployment last year and taking a significant pay cut, Malone now says she has less than $1,000 in savings.

Malone, who as a contract worker doesn't receive retirement benefits, said myRA could help her start saving again.

"Being able to start it with a small contribution (is) very affordable at this point for me," she said. "These days anything saved is a help over $0."

Many readers were worried they would not have enough money to live on in retirement and hoped the new plan could help their situation.

"I'm going to be pretty much dependent on Social Security. But I would like to continue saving," said 67-year-old Kathryn Riss, who stopped saving for retirement after losing her job in 2008. While she found a new job in 2009, she now earns around a third of what she used to and doesn't receive retirement benefits.

She and her husband keep the modest savings they do have in money market accounts, which earn less than 1%. The myRA, on the other hand, will invest in government savings bonds and provide returns of around 2% to 3%, depending on interest rates.

Riss said they would like the security and slightly higher returns that the government-backed accounts would offer. "We don't want something that's really volatile and where there's high risk," she said.

Related: Will you have enough to retire?

But other readers weren't sold. Alaska resident John Baumeister, 43, said he would never put his retirement savings in an investment with such a modest return. While Baumeister receives pension benefits from his job as a firefighter, he also invests in a traditional Roth IRA.

"2% interest is pathetic," he said. "Inflation will swallow your buying power at that rate."

Torrington, Conn. resident Dave Elwell is 24, earns a modest income as a mason's apprentice and receives no retirement benefits, making him the target audience for the myRA program.

Yet, in Elwell's opinion, "myRA is little more than worthless" for a young saver due to the minimal returns.

Instead, he said he will continue to contribute 10% of his pay to the Roth IRA account that he set up around six months ago with an online broker. Elwell said he splits his savings among five mutual funds, which are heavily invested in stocks and have been earning double digit annual returns.

"(Obama is) making it seem like people can take money and put it in this account and really have something special," he said. "But after inflation, what will that really be worth?"