President Obama's new myRA savings accounts have overshadowed the other retirement proposal he is pushing: Curbing retirement tax breaks for the rich.

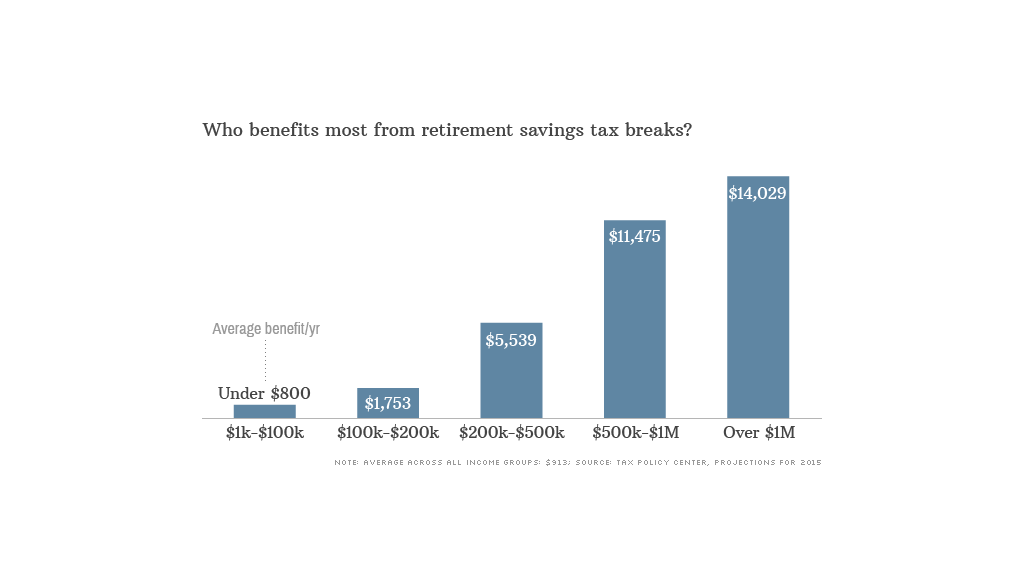

His rationale is that high-income households benefit disproportionately from federal tax subsidies intended to encourage everyone to save for their old age.

In past budget blueprints, Obama has made two specific proposals to correct for this. And the White House has signaled he'll include them again in his 2015 budget, which he is expected to release in March.

Limit savers' combined balance across tax-preferred accounts: Last year, the president introduced the idea of prohibiting contributions to tax-advantaged retirement accounts when a person's combined balance exceeds a certain level. Such accounts include IRAs, 401(k)s and pensions.

The cap on the combined balance would be based on a saver's age and would vary over time based on factors such as inflation and interest rates.

Last year, for instance, the limit would have been $3.4 million for someone who was 62, but just $1 million for someone who was 40, according to a Tax Policy Center report.

The cap would be based on what it takes to buy a "maximum benefit" annuity at age 62, with a 100% survivor benefit for one's spouse. In 2013, a maximum benefit annuity would have provided $205,000 a year.

Of course, account balances go up and down depending on market performance. And so do inflation and interest rates, which can affect the value of a maximum benefit annuity as well as its cost.

Related: What you need to know about Obama's myRAs

So how would Obama's proposal account for such fluctuations?

If the balance is above the cap in one year, the saver "will not be able to make contributions in the following year," the Tax Policy Center explained. But the saver may be allowed to contribute in future years "if interest rates fall, the cost-of-living increases or the balance in her account declines."

The proposal, which is unlikely to get through Congress, would add yet more complexity to the tax code.

It is unlikely to reduce deficits significantly or hit a lot of people initially, the Tax Policy Center noted, citing an analysis that estimated only 0.1% of workers over 60 would be affected.

Cap the value of deductions for retirement savings contributions: Every year he's been in office, Obama has proposed limiting the tax benefit of itemized deductions, as well certain tax exclusions, to 28% of the amount claimed.

Here's how the proposal would reduce the retirement savings tax break for someone in the 39.6% tax bracket:

Say he contributes $10,000 a year to his 401(k). Under current law, that contribution would effectively reduce his annual tax bill by $3,960 (39.6% x $10,000). Under the president's proposal, it would only do so by $2,800 (28% x $10,000).

The Tax Policy Center estimates the proposal would affect mostly individuals who make more than $200,000 and married couples above $250,000.

The prospects for the proposal advancing through Congress remain slim, because few expect tax reform to happen anytime soon.