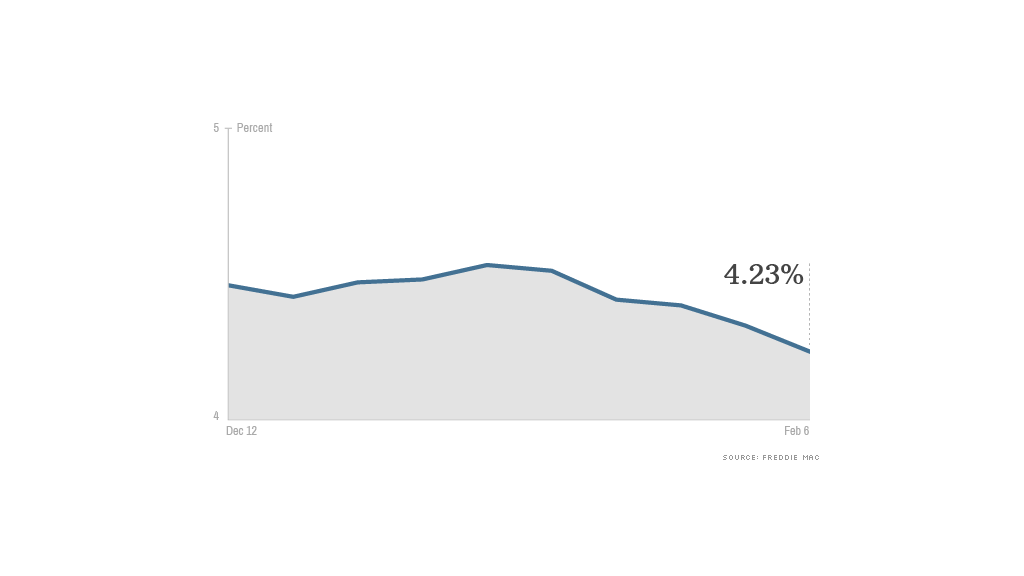

Maybe the days of rock-bottom mortgage interest rates aren't numbered, after all. Once again, rates are creeping down towards 4%.

Rates dropped 0.09 percentage point this week to 4.23% for a 30-year, fixed -rate home loan, according to the latest weekly report from Freddie Mac.

Mortgage rates started the year at 4.53%, and have sunk each week in 2014, falling a total of 0.3 percentage point.

Borrowers with a 4.23% mortgage would pay $982 a month on a $200,000 balance, compared with $1,017 on a 4.53% loan.

Frank Nothaft, Freddie Mac's chief economist, attributed the move to cooling home sales.

Related: Top 10 cities people are moving to

"Mortgage rates fell further this week following the release of weaker housing data," he said. "The pending home sales index fell 8.7% in December to its lowest level since October 2011."

The drop in mortgage bond purchases by the Federal Reserve, the so-called taper, that started last month, was expected to push rates gradually higher.

Related: Hottest housing markets

But worrisome economic news and a plunge in stocks has counter balanced the Fed action, according to Keith Gumbinger of HSH.com, a mortgage information company. Anxious investors have scurried to safe havens like treasury bonds and mortgage backed securities.

"Much to the benefit of mortgage shoppers, this move [to bonds] is dragging down yields and mortgage rates," said Gumbinger. "This is a nice surprise" for people looking to purchase or refinance their homes in a rising rates environment, he said.

Rates may keep dropping, according to Gumbinger.

"The reduction in Fed support, slowing manufacturing activity here and in China, some less-than-stellar figures on consumer spending, housing, and more are causing some concern that the economy has decelerated over the last couple of months," he said. "The economy doesn't need to slow very much to put us back into the kind of funk we've been hoping to escape since the recovery began several years ago."