Worries over global growth could hurt markets Thursday after surveys showed a loss of momentum in Chinese and European manufacturing.

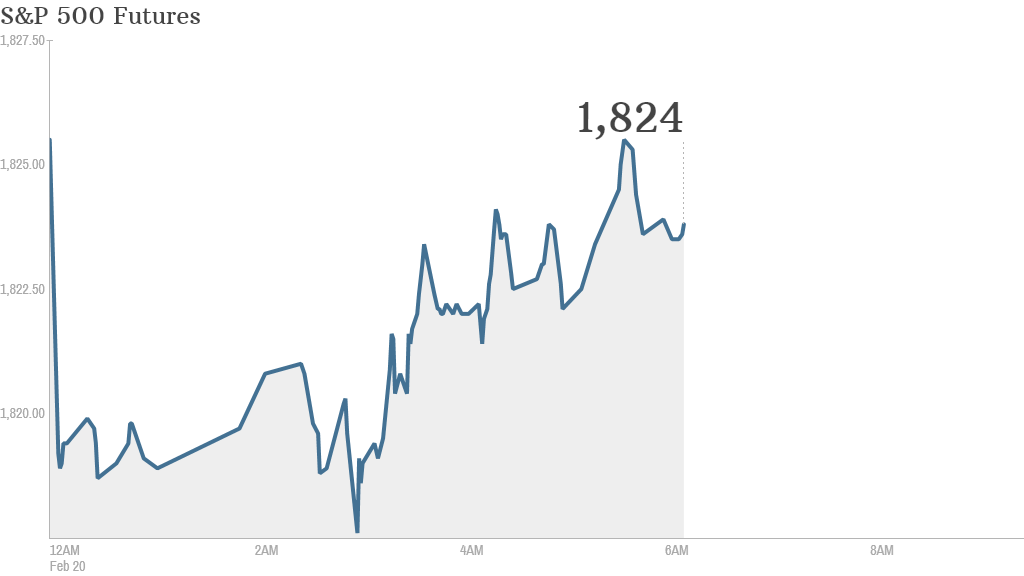

U.S. stock futures were pointing slightly lower and stock markets in Europe and Asia were in the red.

HSBC's preliminary reading of Chinese manufacturing activity fell to a seven-month low in February. A survey of European purchasing managers also came in weaker than analysts were expecting.

On the U.S. economy, the government is set to report the monthly consumer price index, its key measure of inflation, at 8:30 a.m. ET. It will also release its weekly report on initial jobless claims.

Investors will also have plenty of corporate news to digest when the markets open.

Related: Fear & Greed Index, still dwelling in fear

Shares in Facebook (FB) are set to fall after the social networking company said it had bought messaging platform WhatsApp for $19 billion in cash and stock.

Still, analysts for Goldman Sachs (GS) said they believed the acquisition made strategic sense because it "will help drive increased engagement." They rate Facebook a "buy."

Tesla (TSLA) shares could surge by roughly 12% when trading opens after the company reported much stronger than expected profits and forecast it will sell 55% more vehicles this year than last.

Related: Jack Lew discusses minimum wage, immigration and Bitcoin

Shares in BAE Systems (BAESF) were down by about 10% in London after the defense contractor warned that U.S. budget cuts would hurt earnings in 2014.

Safeway (SWY) shares could also move up after the supermarket chain's management announced they are in talks to sell the company.

Wal-Mart (WMT), DirecTV (DTV) and Actavis (ACT) are set to report quarterly earnings before the opening bell. Actavis shares soared earlier this week when it said it would buy Forest Laboratories (FRX) for $25 billion.

Hewlett-Packard (HPQ), Groupon (GRPN) and Priceline.com (PCLN) are among the companies reporting earnings after the bell.

Related: Bank of America CEO gets 17% pay hike

U.S. stocks ended lower Wednesday. The Dow and S&P 500 shed more than 0.5%, and the Nasdaq lost 0.9%.

European markets were all in the red in morning trading, with the DAX in Germany declining by roughly 1.2%.

All Asian markets except for the main index in Australia closed with losses. The Nikkei in Japan took the biggest plunge, dropping by 2.2%.