Rising tensions in Ukraine and testimony from the head of the Federal Reserve will keep investors on the edge of their seats Thursday.

In a challenge to Ukraine's new leaders, dozens of armed men seized the regional government administration building and parliament in Ukraine's southern Crimea region Thursday and raised the Russian flag. That followed surprise military exercises by Russia on Ukraine's doorstep Wednesday.

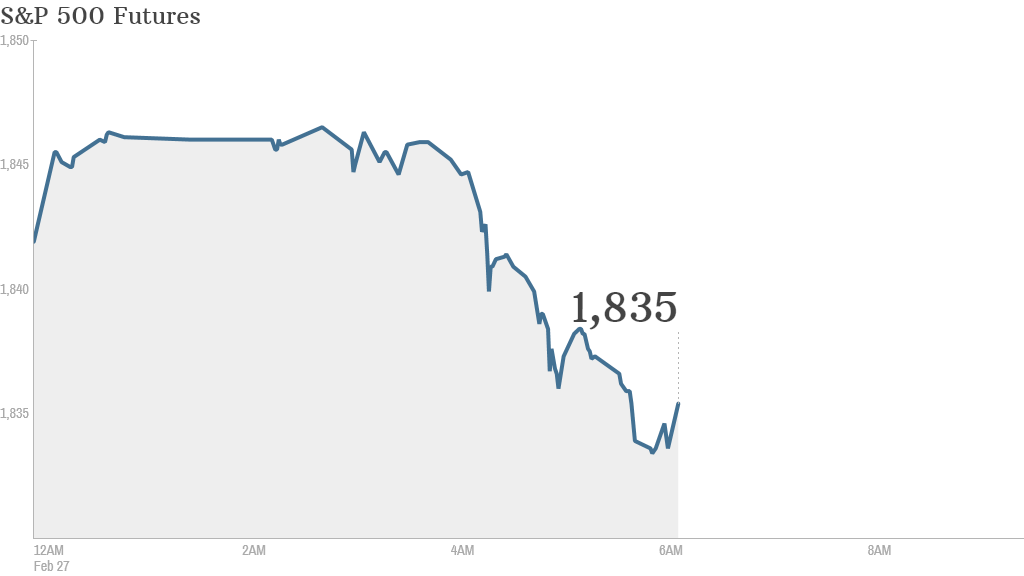

U.S. stock futures, which had been trading higher, turned lower on the reports of rising military tension.

"That Russia's leadership would react negatively to the overthrow of a pro-Moscow administration in Kiev is hardly a surprise," wrote Kit Juckes, global strategist for Societe Generale in London. "But the market's mood has soured somewhat at the latest developments and risk appetite has been hit."

Related: CNN coverage of Ukraine crisis

Investors around the world are also awaiting testimony from the head of the Federal Reserve as they look for clues about future monetary policy.

Yellen, who just took on the role of Fed chair, will testify before the Senate Banking Committee at 10 a.m. ET and her comments could have a significant impact on market sentiment.

Yellen was originally scheduled to speak two weeks ago when she also testified before the House, but her appearance was delayed due to bad weather.

Also on the economic front, the U.S. government will release its weekly report on initial jobless claims and its monthly report on durable goods orders, both at 8:30 a.m. ET.

Plenty of stocks were on the move ahead of the opening bell.

Shares in J.C. Penney (JCP) look set to soar by more than 15% when the markets open. The retailer reported a narrower-than-expected loss for the fourth quarter after the close Wednesday, and said it expects same-store sales to rise by 3% to 5% during the current quarter.

Tesla (TSLA) stock is also getting a boost Thursday morning after the automaker announced it was raising $1.6 billion to fund its expansion plans.

Shares in the Chinese search engine Baidu (BIDU) were rising in premarket trading after the company posted solid earnings and sales.

Meanwhile, investors are awaiting quarterly earnings before the opening bell from the likes of Best Buy (BBY) and Kohl's (KSS).

Salesforce.com (CRM) and Gap (GPS) will report after the close.

U.S. stocks closed little changed Wednesday. After coming in sight of another record high, the S&P 500 rose less than a point for the day. The Dow Jones Industrial Average and the Nasdaq rose just a handful of points each.

European markets were under pressure in morning trading, with Germany's DAX index leading the way lower.

Asian markets ended with mixed results. The main indexes in Australia and Japan pushed down while other markets posted gains. The Hang Seng in Hong Kong did particularly well Thursday, registering a 1.7% gain.