Escalating tensions in Ukraine are rattling world markets, pushing global stocks down and sending U.S. stock futures lower.

Russia has moved forward with military intervention in Ukraine, and Ukraine's new leaders are accusing Russia of declaring war.

The political conflict has pushed the country to "the brink of disaster," Ukraine's interim prime minister Arseniy Yatsenyuk said Sunday.

This comes despite threats of serious sanctions against Russia from the U.S. and Europe.

Political risk expert Ian Bremmer from Eurasia Group is calling this crisis "the most seismic geopolitical events since 9/11."

Related: 5 reasons Ukraine matters to the world economy

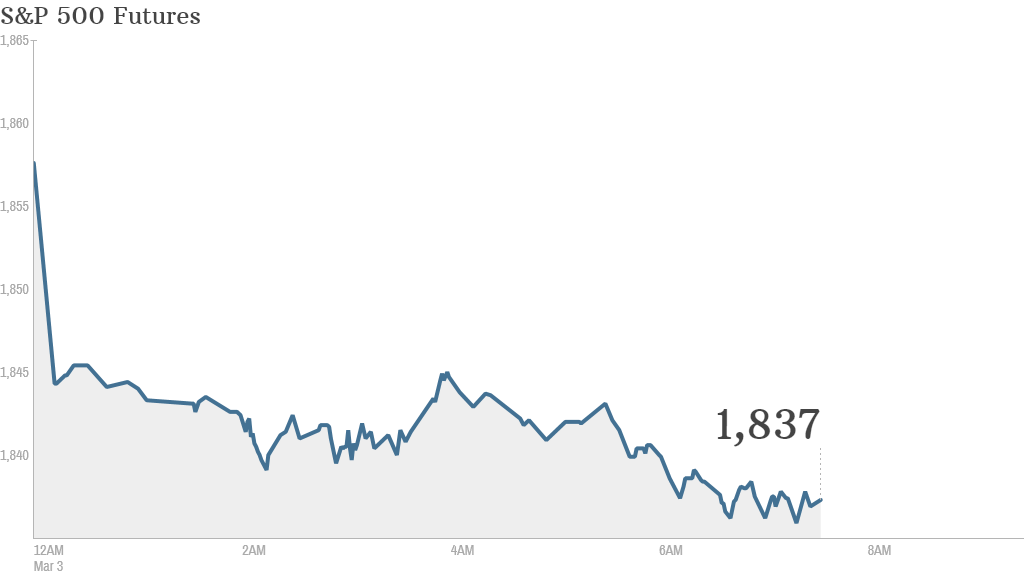

None of this is sitting well with investors -- U.S. stock futures were declining by about 1% ahead of the opening bell.

Russia's Micex index tanked by as much as 11%. Russia's central bank reacted by hiking interest rates, saying it wanted to maintain financial stability and inflation levels as market volatility increases.

All the major European stock markets were tumbling in midday trading, with Germany's Dax down by more than 3%. France's CAC 40 was declining by 2.4% and London's FTSE 100 was off by roughly 2%.

Simon Smith, chief economist at FxPro summed up the volatility in a note to clients: "Geopolitical concerns have a habit of distorting the markets and in this case they could continue to do so for as long as the Ukraine issue remains in the headlines."

There was also plenty of red in Asian stock markets. Hong Kong's Hang Seng index closed 1.5% lower and Tokyo's Nikkei dropped 1.3%. Stocks in Shanghai and Shenzhen bucked the trend and moved higher.

Meanwhile, gold prices are rising by almost 2% to nearly $1,345 per ounce as investors seek safe-haven assets.

The price of oil is also up, with Brent crude prices rising by 1.5% to nearly $111 per barrel.

"Russia's involvement clearly magnifies the scope for contagion and increases the possibility that global energy prices will be affected both directly and indirectly," wrote Stephanie Flanders, chief European market strategist for JPMorgan asset management in London.

Related: Fear & Greed Index still greedy

In company news, Men's Wearhouse (MW) said Monday that it hasy entered into merger talks with its rival retailer Jos. A. Bank (JOSB).

Looking ahead to the economic announcements of the day, the U.S. government will release January numbers on personal income and spending at 8:30 a.m. ET..

The Institute for Supply Management's monthly index on the U.S. manufacturing sector will be released at 10 a.m. February auto sales will come throughout the morning from the major carmakers.

On the corporate front, 3-D printer company Stratasys (SSYS) will report earnings before the open and SolarCity (SCTY) will report after the close.

Related: Investors pin hopes on strong jobs report

Stocks closed mixed Friday -- the Dow Jones industrial average closed slightly higher and the Nasdaq ended down. The S&P 500 set a new closing record of just under 1,860, ending February on a high note. Overall, the S&P 500 added more than 4% in February, a rally that marks a turnaround from January's slump.

But whether the record streak continues in March largely depends on the economic data on tap this week, and how investors continue to view Ukraine's political crisis.