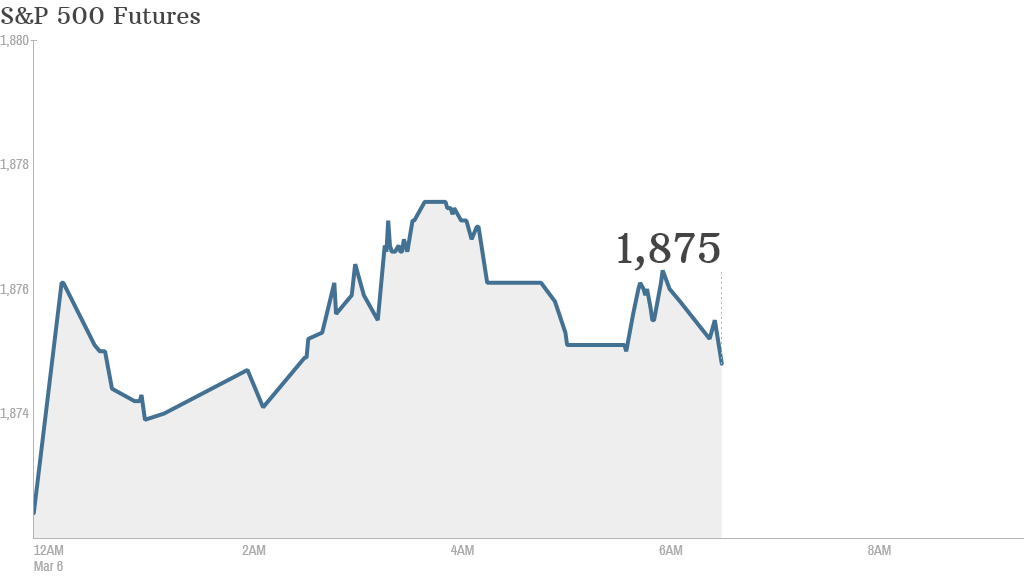

Markets seemed to have regained their composure after some sharp volatility earlier in the week.

U.S. stock futures were edging higher Thursday, just days after a Ukraine-Russia military standoff threatened to derail the bull market.

While the crisis in Ukraine remains unresolved, U.S. investors now seem to feel relatively insulated, believing the worst-case scenario of a full-fledged war is unlikely.

The latest reading from the CNNMoney Fear & Greed index shows greed is most definitely driving markets again.

Related: Fear & Greed Index slides into extreme greed

Looking to the economic news of the day, investors are waiting for the U.S. government to publish its weekly initial jobless claims report at 8:30 a.m. ET. January factory order numbers will be out at 10 a.m.

On the corporate front, the grocery store chain Kroger (KR) will report earnings before the bell.

Staples (SPLS) shares fell in premarket trading after the office supplier reported a slump in last year's sales and announced that 225 stores will be closed by the middle of 2015.

Discount retailer Costco (COST) reported a gain in quarterly revenue and profit, as well as same -tore sales.

Shares took off for Pluristem Therapeutics (PSTI) after the biotech got the green light from the Food and Drug Administration to manufacture placenta-based cell therapies in Israel.

H&R Block (HRB) and Quicksilver (ZQK) will report after the close.

Shares in Facebook (FB) were up slightly before the open. This week's TechCrunch report suggesting that Facebook is in talks to buy drone maker Titan Aerospace put Facebook investors in a particularly good mood.

Related: A sense of calm returns to the markets

European markets were buoyant in midday trading. The CAC 40 index in France was making the biggest advance, up by 0.6%.

Investors and traders in Europe are waiting for the latest interest rate decision from the European Central Bank. It's widely expected that the ECB will not make any changes to current policy. An announcement will come at 7:45 a.m. ET.

"The normalization of markets since the beginning of the week has been stark, so today investors can focus on one of the major risk events that traders have been building up to for quite some time now ... the ECB meeting," said Angus Campbell, a senior analyst at FxPro.

Asian markets all closed with gains. Japan's Nikkei led the way with a 1.6% jump.