The U.S. economy in the next two years is well positioned for growth assuming no adverse shocks or bad policy decisions.

That's the view from the White House, which released President Obama's 2014 Economic Report on Monday.

The report offered several reasons for that assessment. Among them:

Households have less debt and more wealth: U.S. households now have 1.1 times more debt than they have disposable income. That's down from 2007, when the ratio was 1.4.

And the amount of money they spend on credit card and mortgage interest as well as other debt service has also fallen to its lowest level since 1980, according to the report.

Related: Recovery on track, but still slow and steady

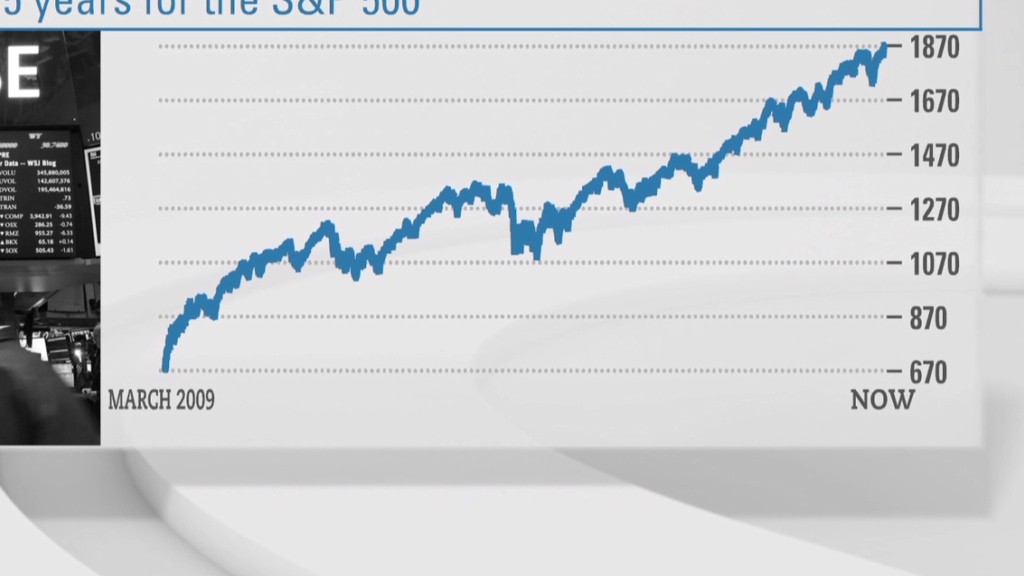

On top of that, households with access to the stock and housing markets saw big gains in 2013, bolstering their net worth.

Those factors combined are likely to increase Americans' desire to spend, especially on big-ticket items like cars, the report noted.

Washington is less of a liability: The rabid fiscal fights of the past few years are over, for now anyway. And the fiscal consolidation that resulted from the agreements reached over debt ceiling standoffs and the fiscal cliff isn't likely to be as much of a slowdown going forward.

"Federal fiscal policy will be much less of a drag in 2014 and thus will likely constrain overall growth by less than during the preceding years," the report said.

Steady housing demand: So-called household formation took a dive during the Great Recession, so there is likely to be pent-up demand for housing going forward.

What's more, the report asserted, "as employment prospects improve, household formation is likely to pick up."

Household formation can result from adults being financially able to move out of their parents' house or ditch the roommates, to new college graduates who get jobs and don't move back home.

The White House did caution, however, that "stronger housing demand depends critically on the easing of credit standards (that may have been overtightened following the financial crisis)."