As much as investors and traders may want to forget about it, concerns about worsening relations between the West and Russia over the fate of Ukraine is weighing on market sentiment.

And a U.S. Federal Reserve policy meeting is injecting some uncertainty into the markets.

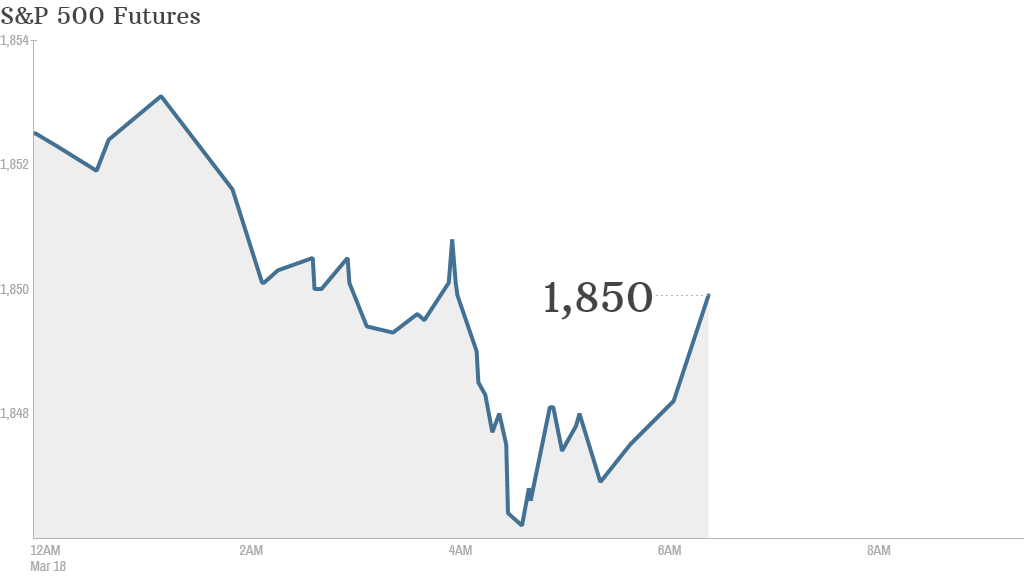

U.S. stock futures were modestly higher as investors hope to build on Monday's relief rally that pushed the major indexes up about 1%.

But concerns remain that the situation in Ukraine will continue to dominate the headlines, putting further strains on Russia's relationship with the U.S. and Europe. Russia is not backing away from plans to annex Ukraine's Crimea region despite targeted sanctions announced Monday.

Investors are also monitoring Janet Yellen's first meeting as head of the Fed. The two-day meeting, which kicks off Tuesday, is expected to yield a continued winding down of the central bank's stimulus program.

Related: Fear & Greed Index idling in neutral

"An expectation that the Federal Reserve will subtract an additional $10 billion from the current quantitative easing program has led to a notably softer start [in equities]," explained Brenda Kelly, chief market strategist at trading firm IG.

In other economic news, the U.S. government will publish home construction numbers from February, as well as the consumer price index, at 8:30 a.m. ET.

On the corporate front, shares Hertz (HTZ) announced quarterly earnings and said it would spin off its equipment rental business to pay off debt. DSW (DSW) will report earnings before the bell. Oracle (ORCL), Adobe Systems (ADBE), SolarCity (SCTY) and Pacific Sunwear (PSUN) will report after the close.

The stock price of Qiagen (QGEN) jumped in premarket trading after the German medical laboratory company announced a share buyback.

The major European markets were all declining in morning trading. Asian markets ended higher.