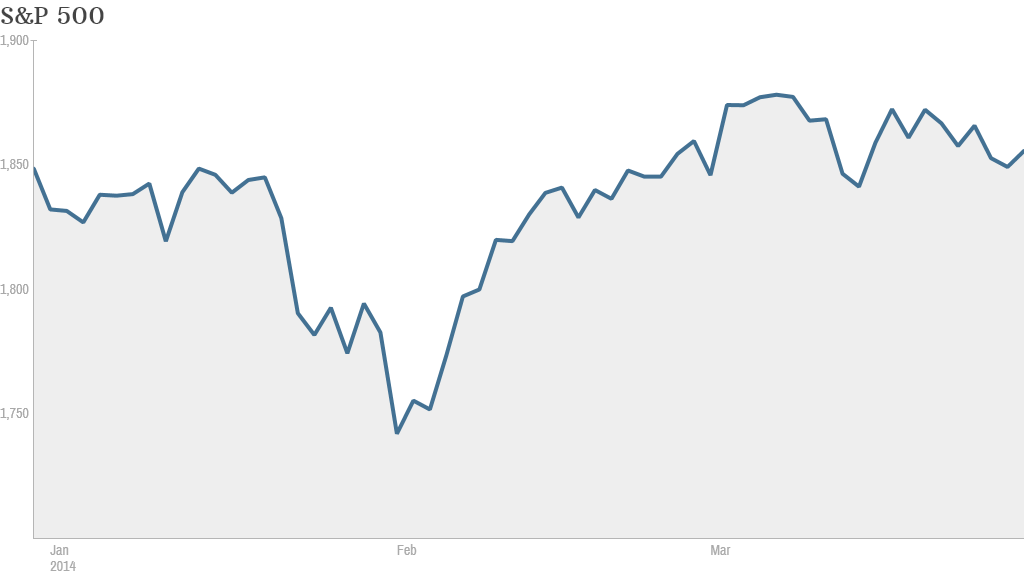

As the first quarter comes to a close this week, investors will be watching to see if the "keep calm and carry on" mantra will return.

Trading was choppy in the first three months of the year, with the crisis in Ukraine and questions about when the Fed will hike interest rates taking center stage.

On top of that, unusually harsh winter weather in many parts of the country made it difficult for investors to figure out if the economy is really losing steam or not.

Are the winter blues gone? Investors will get a slew of data about the U.S. economy this week. There's manufacturing, construction spending, and auto sales numbers due out on Tuesday and the all-important March jobs report Friday.

"This week we expect to see more evidence that the economy is recovering from the temporary weakness triggered by the unusually severe weather," said Capital Economics analysts in a research note.

A 200,000 increase in payrolls "would show that the freezing in jobs growth has continued to thaw," the analysts added.

Hiring surprisingly picked up in February, with the economy adding 175,000 jobs. The unemployment rate ticked up to 6.7% from 6.6% the prior month as more Americans attempted to join the labor force.

Despite the bad weather, construction was a bright spot in the economy last month. But the same can't be said for the automotive sector, as sales have cooled off in early 2014.

Rough seas from across the pond? Europe is also likely to be a big story. It's possible that further volatility could arise as European Central Bank Chief Mario Draghi makes his monetary policy announcement Thursday.

Low inflation in the Eurozone has led to speculation that the ECB will further stimulate the economy. Meanwhile, the Federal Reserve is scaling back its economic stimulus.

Comments by Draghi last week on the importance of fighting deflation only fueled speculation about some sort of action. It caused the euro to fall sharply against the dollar. Any additional stimulus measures would likely weaken the euro and boost exports and the EU economy.

Related: Germany challenges Europe's crisis bond plan

But Andrew Milligan, head of global strategy for Standard Life Investments in Edinburgh, doesn't think the ECB will actually announce more stimulus on Thursday. Rather, he thinks Draghi was using the power of words to impact the market. Draghi was essentially able to drive down the euro without actually having to take material action.

The ECB will also announce on Thursday whether it's cutting interest rates, which are already near zero, even further.

GM to get grilled: The most anticipated corporate news event will come Tuesday when General Motors (GM) CEO Mary Barra testifies before Congress over her company's handling of a flawed ignition switch for the Chevy Cobalt, among other vehicles.

Related: Lawyer wants recalled GM cars off the road

GM has been criticized because it has admitted that some employees were aware of problems with the ignition switch in small cars at least as early as 2004. But the company did not recall 1.6 million cars with the problematic switch until last month. General Motors now says the recall covers 2.2 million vehicles sold in the U.S.

The switch flaw led to at least 31 frontal accidents and at least 13 deaths, according to statistics released by GM. That number could rise as further investigations take place.

Google shares aplenty: If you own Google (GOOG) stock, don't panic Thursday when the price drops in half, because that's the day when the tech giant's long anticipated 2-for-1 stock split goes into effect. Shareholders will get another share for each one they own currently.

The stock split was first announced two years ago, but was held up by a legal battle in which some shareholders raised objections.

The dual share system essentially gives CEO Larry Page, Chairman Eric Schmidt and co-founder Sergey Brin even more say in the company's management decisions.

But Google's management team has rewarded its shareholders. The stock has soared about 40% in the past 12 months.