Markets are finally closed for the week after a truly bumpy ride that ended with investors running for the exits Thursday and Friday.

The weakness in the technology sector appears to be spreading to the broader stock market.

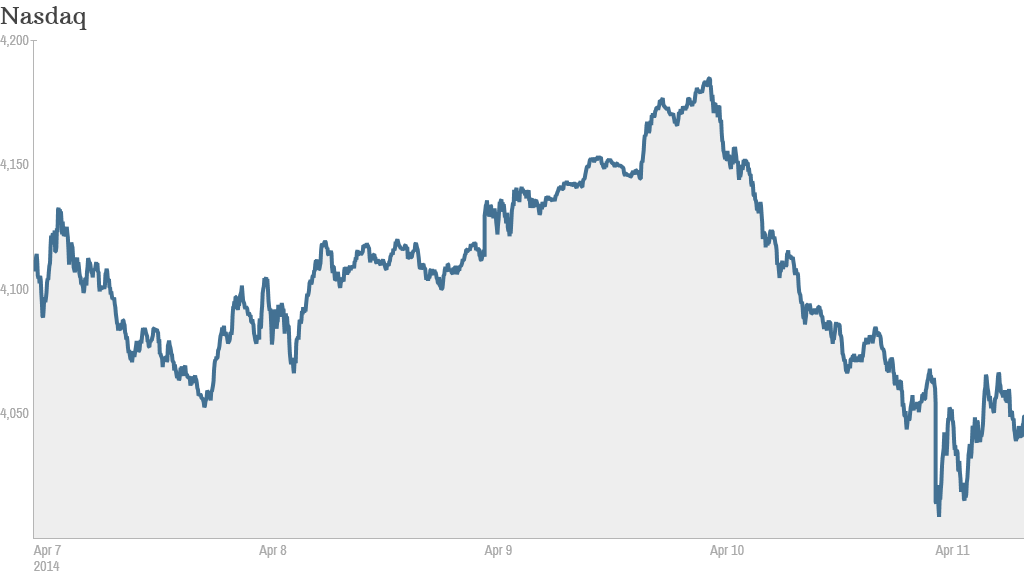

The Nasdaq was the biggest loser. The tech-heavy index fell more than 1.3% to end below 4,000 for the first time since early February. It lost 3.1% for the week.

The Dow Jones Industrial Average fell 143 points after JPMorgan (JPM) reported weaker-than-expected earnings growth. The blue-chip average sank 2.3% for the week, falling after three weeks of gains.

The S&P 500 was down nearly 1% today with selling in all sectors. Information technology was the hardest hit, but more defensive sectors such as utilities and telecoms were also under pressure. For the week, the S&P 500 fell 2.6%.

It's a sharp reversal for the broad market gauge, which hit an all-time high just last week.

All three major U.S. market indexes are now down for the year.

Related: Investors aren't bringing sexy back

The main catalyst for this week's sell-off was a souring on so-called momentum stocks, including shares of many technology and healthcare companies. The firms had been trading at very high prices relative to expected earnings growth.

For example, two popular exchange-traded funds that own biotechnology stocks (IBB) and small-cap stocks (IWM) both fell about 4% this week.

But the concern now is that the sell-off is spreading to other parts of the market.

"The market has run out of momentum stocks to crush, so it is moving to the fat ladies aka $SPY and $DIA," said StockTwits user ivanhoff, referring to exchange-traded funds that mirror the S&P 500 and the Dow.

Stocks have been on a wild ride so far in 2014.

According to Schaeffer's Investment Research, the Nasdaq has experienced a gain or loss of 1% or more on 21 trading days since January 1. That's roughly double the number from the same period last year.

Related: Fear & Greed Index still gripped by fear

In corporate news, Herbalife (HLF) shares plunged after the Financial Times reported that federal law enforcement authorities are investigating the company. Herbalife, which sells nutritional supplements via a network of independent distributors, is already the subject of a Federal Trade Commission probe.

Hedge fund manager Bill Ackman has repeatedly called Herbalife a pyramid scheme and has a very public $1 billion bet against the company's stock.

Before the market opened, JPMorgan said earnings were hurt in the first quarter by weakness in bond trading, while consumer lending and deposits were a bright spot. Despite the lackluster report, CEO Jamie Dimon said he has "growing confidence in the economy."

JPMorgan shares fell more than 3%. "$JPM nothing to see please move along and carry on," wrote LAstarDCstar

Related: JPMorgan profits sink, but Dimon confident

The news was a bit rosier for Wells Fargo (WFC), which reported a double-digit profit gain for the first quarter.

Citigroup (C), Bank of America (BAC), Morgan Stanley (MS) and Goldman Sachs (GS) will report results next week.

Overall, earnings for the companies in the S&P 500 are expected to fall 1.2% in the first quarter, according to FactSet Research. That would mark the first annual decline since the third quarter of 2012.

One of the biggest losers today was J.C. Penney (JCP), though there was no clear trigger for the selling. The retailer's stock ended the day down 9.6%.

"$JCP WHERES THE NEWS! 12% plunge doesn't just happen!!!!!!!," wrote TheEngine3r on StockTwits.

H&R Block (HRB) shares jumped initially after the company said it will sell its bank to Bofl Federal Bank, but the stock ended the day lower. Shares of retailer GAP (GPS) slid after the retailer reported a sales decline for March.

Finally, confirming that the business world also has plenty of "relationship status" updates, shares of IAC/InterActiveCorp (IACI) jumped after a Bloomberg report said Barry Diller's media conglomerate paid $500 million to buy another 10% of the Tinder online dating service from a venture capitalist. The investment values Tinder at $5 billion, according to the report.

Not all traders were buying the rich valuation, however. "Are you kidding me $IACI?! Tinder hasn't even started monetizing yet!," wrote NextTrade1122.

Related: Tech stock rout continues in Asia

The rout in tech shares spilled over into Asian markets Friday. Shares of Tencent (TCEHY) plunged 6.8% and Samsung (SSNLF) fell 5%. The Nikkei index plunged 2.4%, taking its loss for the week to 7.3%.

European markets were also caught up in the fallout from Wall Street's slump.