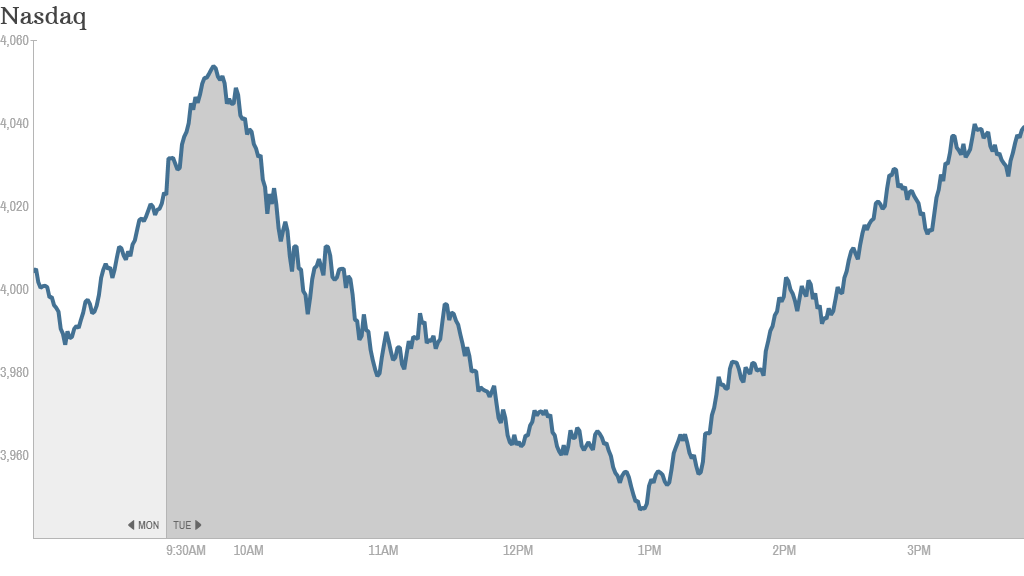

Investors seemed to have trouble making up their minds Tuesday. Stocks rallied out of the gate, then languished for most of the day before sprinting into the close.

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq all ended the day higher, shaking off worries that certain technology stocks are overvalued.

The Dow ended higher for the fifth Tuesday in a row, reviving talk about Turnaround Tuesday. Last year, the Dow had an unprecedented run of 20 winning Tuesdays in a row. So far this year, it has gained on 11 of the past 15 Tuesdays.

Trading volume has been light this week, with many market participants taking time off for the Passover holiday. U.S. markets will be dark on Friday in honor of Good Friday.

With fewer shares trading hands, the market tends to be more volatile.

Related: Fear & Greed Index slides into extreme fear

In addition, trading could be even more choppy this week because options contracts that were set to expire Friday will need to be settled earlier, said J.J. Kinahan, chief derivatives strategist at TD Ameritrade. That could cause big moves in the underlying securities.

Investors' nerves have been frayed by wild swings in so-called momentum stocks over the past few weeks. Biotech and internet stocks have been battered as investors worry that they have become overvalued following last year's big rally.

Related: Investors hit the brakes on Tesla stock

"What we have been witnessing is a nasty round of profit taking, as investors who rode the momentum higher are booking their gains and stepping aside," said David Joy, chief market strategist at Ameriprise Financial.

But at least one battered momentum stock was back in fashion Tuesday. Twitter (TWTR) shares surged more than 11% after the social media company announced that it had hired a former Google (GOOG) executive to help run its consumer division and that it would acquire data startup Gnip.

The rally did not go unnoticed on StockTwits, the Twitter-like social network for traders.

"I think today is a significant event in $TWTR and this should not be taken lightly. We'll look back to today and point to it. Watch," said a user using the handle allstarcharts.

Another user suggested the rebound could bode well for other momentum stocks.

"$TWTR didn't twitter sort of lead this momo correction? maybe this pop is a leading indicator?," read a post by zv2013.

Still, other traders weren't so sure the rebound will last.

"$TWTR dream or for real?," asks Torpedo.

Geopolitical concerns were also at play as Ukrainian forces moved against pro-Russian separatists in the restive eastern Donetsk region.

Related: Ukraine hikes rates in bid to defend economy

Some traders on StockTwits were bracing for an escalation of the crisis, which has been simmering for weeks.

"$SPY Tension is brewing. Ukraine took back airfield, this is the beginning," wrote bkahuna123.

But others downplayed the geopolitical turmoil, pointing instead to the carnage in momentum stocks.

"$SPY Ukraine is an easy scapegoat but let's talk about the elephant in the room...the MOMO slaughter. Sorry, that is not just 'rotation,'" read a post by Scaletrader.

Meanwhile, corporate earnings are in focus this week with nine Dow companies and 10% of the S&P 500 set to release first quarter results.

After the market closed, Yahoo (YHOO) and Intel (INTC) both reported quarterly earnings that beat analysts' expectations.

Overall, earnings in the first quarter are expected to fall 1.6% versus last year, according to FactSet Research.

"We're moving into the heart of earnings season now," said Art Hogan, chief market strategist for Wunderlich Securities. "We've got a lot of financial reporting this week. The bars are set low enough that earnings expectations are in line with reality."

Coca-Cola (KO)and Johnson & Johnson (JNJ) both surprised investors Tuesday morning with better than expected results. This follows good news yesterday from Citigroup (C). Thus far, the only major disappointment has been JPMorgan (JPM).

In economic news, the Consumer Price Index rose 0.2% in March, compared with the 0.1% rise economists had predicted. Excluding food and energy prices, the index increased 0.1%, matching expectations.

Related: Housing, food costs on the rise

A measure of manufacturing activity in the New York area unexpectedly fell in April. The so called "empire index" fell to 1.3 this month, according to the Federal Reserve Bank of New York. Economists were expecting an increase.

European markets are fell as tension in Ukraine weighed on sentiment. Asian markets closed with mixed results.