There are many reasons it pays to have a family. Most of them are not financial. Except, that is, when it comes to federal income taxes.

At CNNMoney's request, the Tax Institute of H&R Block calculated the 2013 federal income tax bill of a dual-earner married couple with two young kids -- and compared it to the tax bill of a single person without kids.

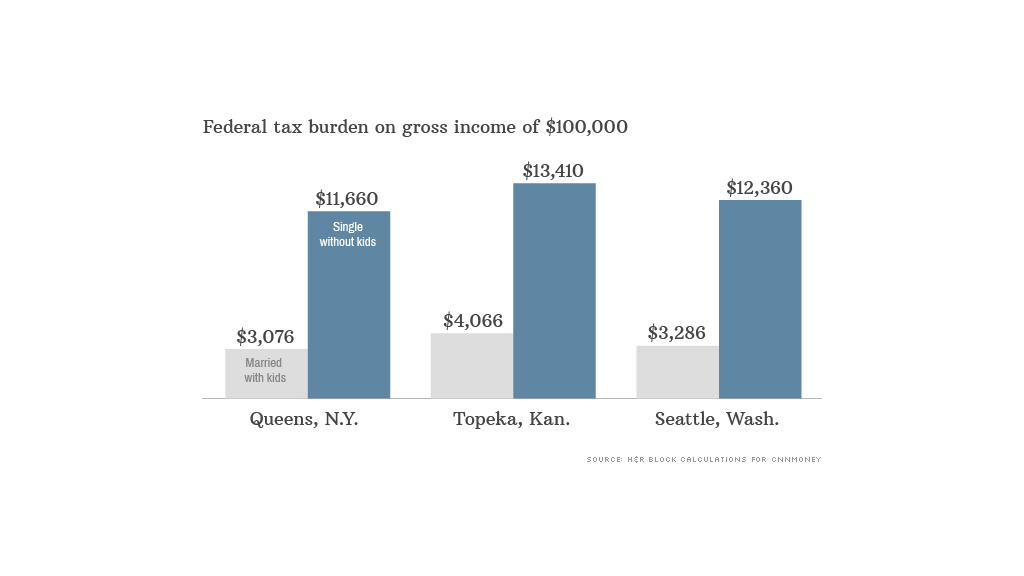

We assumed that both the couple and the single person made $100,000 in wage income. (See below for the other assumptions we made.)

And we looked at what their federal income tax burden would be across three cities: Seattle, Topeka and Queens, N.Y.

What we found: The single person paid much higher taxes in all three places -- between three and four times more.

In Queens, the single person's bill came to $11,660 versus $3,076 for the married couple.

In Topeka, the single person paid $13,410, and the married couple paid $4,066.

And in Seattle, the tax bills came to $12,360 versus $3,286.

The yawning gap held up even though each city has different state and local taxes, which influence how much federal tax people pay.

Why the huge disparity: The reason for the big differences is mostly a host of child-related tax breaks the couple can take on their federal return -- such as the child tax credit and other breaks for child care and dependents.

"Phase-out" rules also play a role. Phase-outs reduce or eliminate the value of a tax benefit the more you make, but they kick in at a higher income level for married couples than for singles.

In our example, one of the assumptions we made was that one spouse in the couple, as well as the single person, took graduate classes and had student loan debt.

The married couple would enjoy the full student loan interest deduction and the full lifetime learning credit because their adjusted gross income ($82,500) falls below the level at which those tax breaks start to phase out for joint filers.

But the single person's AGI ($90,000) is too high to get any tax benefits from his education-related expenses.

What could narrow the gap: The differences between the two $100,000 households would be less stark if one compared a married couple with young kids to that of a single custodial parent who files as head of household. That's mostly because the single parent would gain the benefit of the child-related tax breaks.

Likewise, the gap would narrow if only one spouse in the married couple worked since they likely would no longer be able to claim childcare tax benefits, which require that both spouses have jobs or are looking for work, according to the Tax Institute.

And if neither the married couple nor the single person had kids, their federal income tax burdens would likely be more similar as well.

This story is part of a CNNMoney series exploring Americans' real tax burden. We'd love to hear how you feel about yours at #YourEconomy.