Investors took another ride on the momentum stock roller coaster Monday.

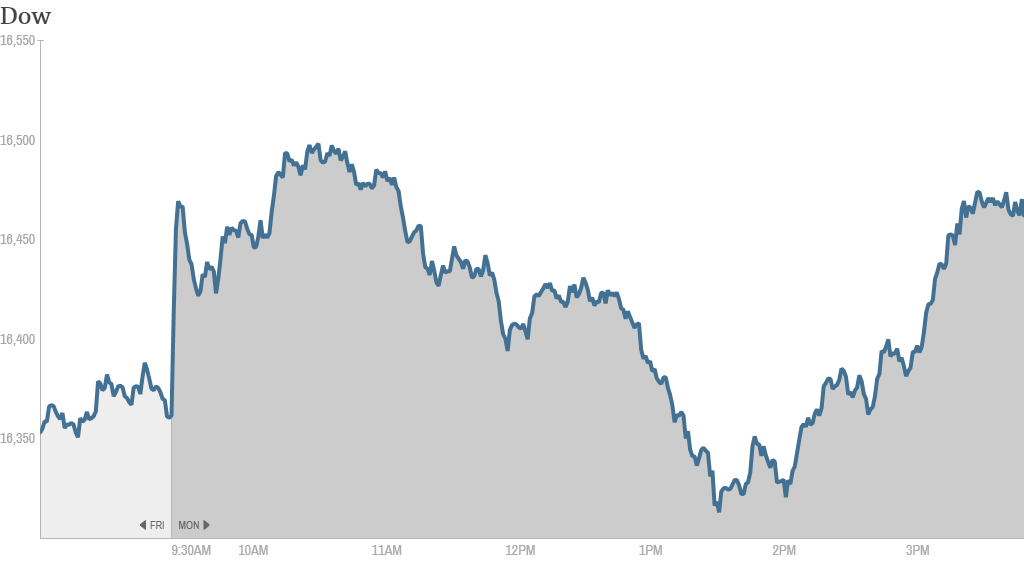

The Dow Jones industrial average and the S&P 500 both recovered from afternoon weakness to end the day slightly higher. The Nasdaq ended the day flat after being down more than 1% earlier in the day.

Stocks started the day on a positive note -- the Dow was up over 125 points at mid-morning -- as investors cheered the news of various deal in the works between European and American companies, but the market came under pressure in the afternoon as technology stocks took a tumble. Fortunately, it bounced back late in the day.

More tech selling

Despite the rebound, many of last year's biggest winners were still considerably lower.

Social media companies were hit particularly hard. LinkedIn (LNKD), Facebook (FB), and Yelp (YELP) were all down sharply. So was Twitter (TWTR), which is due to report its first quarter results Tuesday afternoon.

Weibo, (WB) the Chinese social medial company that went public earlier this month, fell 8%.

There was heavy selling in shares of companies that many investors consider to be overvalued, while more stable tech companies were back in fashion. Netflix (NFLX), Amazon (AMZN) and Priceline (PCLN) all fell as investors flocked to dividend payers such as Apple (AAPL) and Microsoft (MSFT).

"$AAPL and $MSFT get an A+ for masking the damage in many of the Nasdaq stocks," read a post by StockTwits user traderstewie.

The big shift to boring and stable

Beyond the carnage in momentum stocks, investors were shifting money into stocks that are considered safe havens and selling shares of companies that are more tied to the economic recovery.

Consumer staples and telecommunications companies were among the best performers, while materials and financial services companies were deep in the red.

The market is about to enter the time of year when stocks historically have underperformed. Analysts say many investors are shifting into more defensive stocks as they brace for a slowdown in trading activity, which typically starts in May.

Related: Get ready for the summer bummer

"At this time of year, it is natural for investors to question whether they should reduce their equity exposure as we move closer to the historically vulnerable May through October period that has coined the old Wall Street adage 'Sell in May,'" wrote Sam Stovall, chief equity strategist at S&P Capital IQ, in a note to clients.

Merger Monday

In more upbeat news, takeover talk is swirling through the markets as Pfizer (PFE) said it has been looking at a $100 billion bid for AstraZeneca (AZN), and General Electric is reportedly attempting to buy Alstom's power turbines business.

The British pound pushed up against the U.S. dollar, trading at its highest level since late 2008, in response to the possibility of a Pfizer takeover of AstraZeneca, noted Kit Juckes at Societe Generale.

Shares in AstraZeneca surged, while Pfizer shares were also edging higher.

"$SPY If it weren't for the $PFE news I really think we would be negative right now. This is something that could be a LT gamechanger $STUDY," read a post by 6killer.

Related: Pfizer eyes AstraZeneca for $100 billion acquisition

Both General Electric (GE)and Germany's Siemens (SIEME) are reportedly looking to buy the power divisions of France's Alstom (ALSMY), though French government officials are said to be concerned about a U.S. takeover.

Trading in Alstom shares has been suspended. The company promised to make a statement by Wednesday at the latest. General Electric has made no comment.

Siemens said it has proposed to discuss strategic options with Alstom, but declined further comment.

Bad math strikes BofA

Bank of America (BAC) shares fell more than 6% after the Federal Reserve required the bank to resubmit its 2014 capital plan because BofA incorrectly reported data used to calculate its capital levels. BofA said it was suspending plans to hike its dividend and increase its share repurchase program.

It's the worst single-day stock drop for BofA since 2012.

Related: Bank of America's big math error

"I just don't understand how a company like $BAC could let something like this happen. Unbelieveable. Keep shooting themselves in the foot," said TradingCommonSense on StockTwits.

Ukraine fears linger

As if there wasn't enough to worry about in the markets, the Ukraine-Russia situation continues to boil. The White House unveiled new sanctions against Russian officials and businesses in response to the escalating crisis in Ukraine. The sanctions target seven Russian officials and 17 entities, including banks and companies tied to Russia's energy industry.

In a major challenge to Kiev's new leaders, armed rebels aligned with Moscow have captured towns and government buildings across eastern Ukraine and are holding a team of European monitors hostage.

But the sanctions were not as severe as some had feared. Russian stocks and the ruble rallied as investors moved back into Russian assets following a sharp sell off.

Related: Fear & Greed Index still in fear zone

J.C. Penney (JCP) shares jumped 9% in what some traders said was a short squeeze, which is when investors who have borrowed a stock in order to profit off its decline are forced to buy it back.

Chinese e-commerce company Alibaba, which is preparing to go public in the United States, announced an investment in the online video website Youku (YOKU). Alibaba and a private equity firm purchased 18.5% of Youku for $1.22 billion. But Youku shares plunged due to concerns about certain U.S. TV shows being banned in China.

Related: Move over Facebook, Alibaba's IPO is coming

Corporate earnings continue to roll in from some major companies. Controversial nutritional supplements marketer Herbalife (HLF) is one of several firms set to report quarterly results after closing bell.

On the economic front, the National Association of Realtors said pending home sales, which reflect transactions that have not yet closed, rose in March for the first time in nine months.

European markets ended the day higher. Most major Asian markets declined Monday.