There's a hush in the markets Monday morning as earnings season wraps up and investors weigh various economic risks.

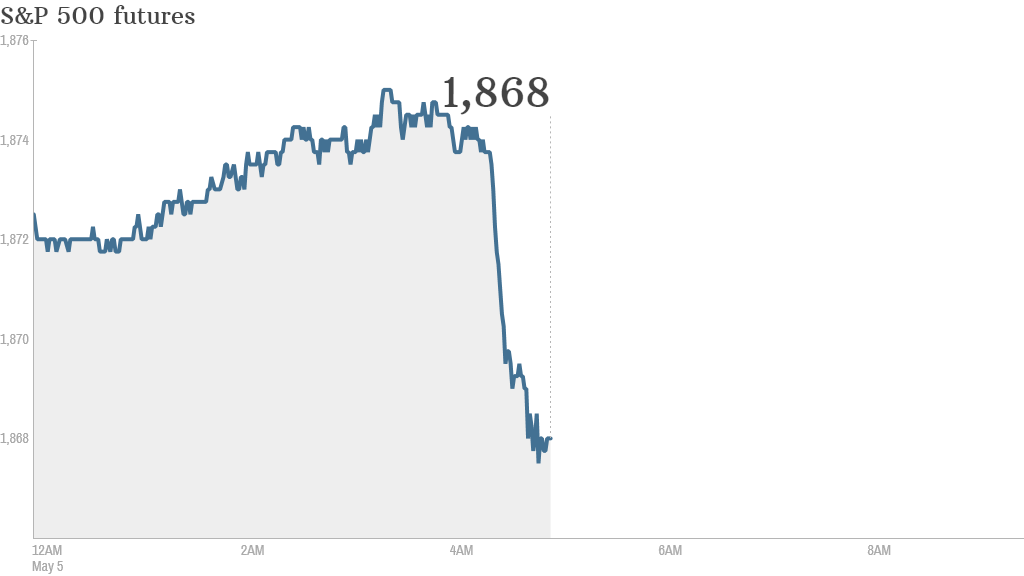

U.S. stock futures were lower ahead of the opening bell.

Worries over growing tensions and lawlessness in Ukraine may be causing investors some unease.

Meanwhile, a new HSBC manufacturing report out of China on Monday showed business conditions continued to deteriorate in April, dampening investor sentiment in Asia.

The latest reading from the CNNMoney Fear & Greed Index suggests investors are increasingly fearful.

Related: All eyes on Janet Yellen this week

Earnings season is winding down, but a few more quarterly releases remain on the docket. Pfizer (PFE) and Tyson Foods (TSN) will report before the opening bell. Pfizer may reveal further information about its plans to acquire the British pharmaceutical company AstraZeneca (AZN).

After the closing bell, gun manufacturer Sturm Ruger (RGR) will report its latest quarterly figures.

Berkshire Hathaway (BRKA) hosted its annual shareholder meeting over the weekend. The company reported earnings Friday that missed expectations.

It's been a quiet start to May for stocks. The Dow Jones industrial average, S&P 500 and Nasdaq all fell modestly on Friday, ending the week in the red. Still, the Dow hit an all-time high last week, and the S&P 500 is close to new heights.

European markets were lower in morning trading. Germany's Dax index was down by just over 1%.

Asian markets ended the day with mixed results. Some international markets were closed Monday, including exchanges in London, Seoul and Tokyo.