Can Janet do it again?

U.S. stocks got a late boost Wednesday from Federal Reserve chairwoman Janet Yellen's remarks to a congressional panel. Investors will be hoping for a repeat performance Thursday when she appears before a Senate committee.

The Dow Jones industrial average and S&P 500 rebounded as Yellen signaled continued Fed support for the economy. The Dow experienced its biggest point and percentage gain since April 16.

Markets will get the latest update on employment when the Labor Department publishes initial jobless claims at 8:30 a.m. ET.

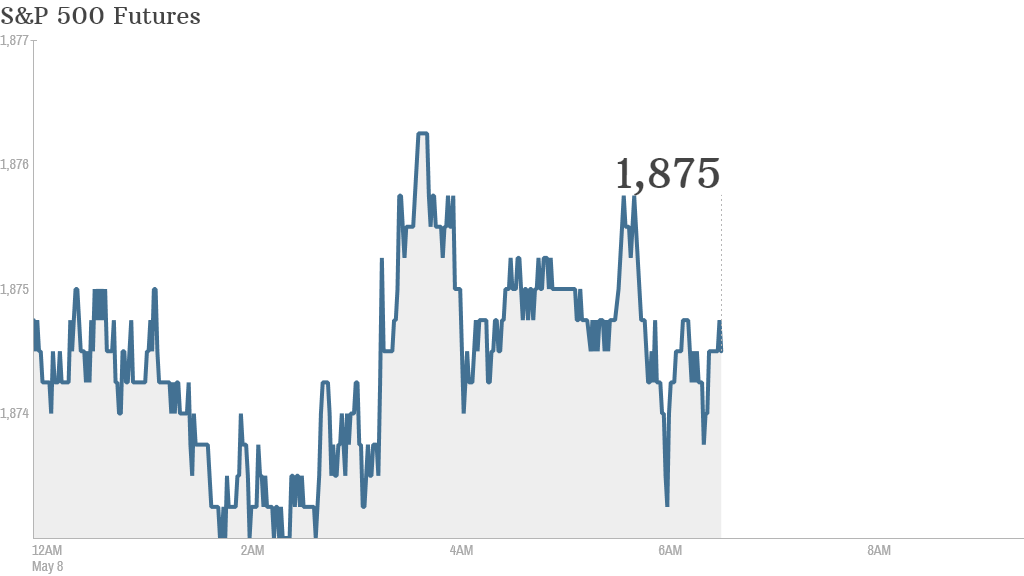

U.S. stock futures were little changed ahead of the opening bell.

"Investors this morning are just taking a slight breather before today's events but I suspect the rally is going to continue," said Peter Cardillo, chief market economist at Rockwell Global Capital.

Related: Barclays to shed 19,000 jobs over three years

Aside from Yellen and jobless claims, he said that investors will be focused on a potential rate decision from the European Central Bank, due around 7:45 a.m. ET.

Marc Chandler, strategist for Brown Brothers Harriman, called the ECB meeting "the key event of the day and week." But he added, "The consensus expects nothing beyond some dovish comments. To the extent that investors expect anything from the ECB, it is not until next month, when the ECB staff updates its macroeconomic forecasts."

On the corporate side, Dish Network (DISH) reported declines in revenue and net income for the quarter, compared to a year earlier. Priceline (PCLN) and Cablevision (CVC) will report earnings before the opening bell. Symantec (SYMC) and CBS (CBS) will report after the close.

Related: Fear & Greed Index still gripped by fear

Barclays (BCS) shares rose 6% in premarket trading after the bank said it would cut 19,000 jobs over the next three years.

Shares in Tesla (TSLA) were declining by roughly 6% in premarkets. The company's earnings beat expectations, but Tesla forecast that expenses will continue to rise as it expands into China, develops its next vehicle and breaks ground on a new factory.

Shares in Keurig Green Mountain (GMCR) popped in extended trading after the company posted earnings that beat expectations.

European markets were all rising in midday trading by roughly 0.5%.

Nearly all Asian markets closed with gains. The Nikkei index in Japan rose by 0.9%.