Get ready for a day that will be dominated by central banks and more retail earnings.

The Federal Reserve is in focus Wednesday as investors wait for the release of the minutes from its April meeting at 2 p.m. ET. Investors and traders will pour over the notes for any new clues on the direction of monetary policy.

"This afternoon's release ... will be read attentively for clues as to where Fed policy is heading, but the market has already decided that any tightening remains far away and will be very slow," said Kit Juckes, a strategist at Societe Generale (SCGLF).

Fed chairwoman Janet Yellen will also be busy, giving a commencement speech to graduates from New York University in the Yankee Stadium at 11:15 a.m.

Her address won't necessarily yield anything new, but markets will still be playing close attention.

The Bank of England released minutes from its latest meeting Wednesday showing members continue to be watchful of the buoyant housing market. The Bank of Japan announced it was sticking with its current monetary policy stance.

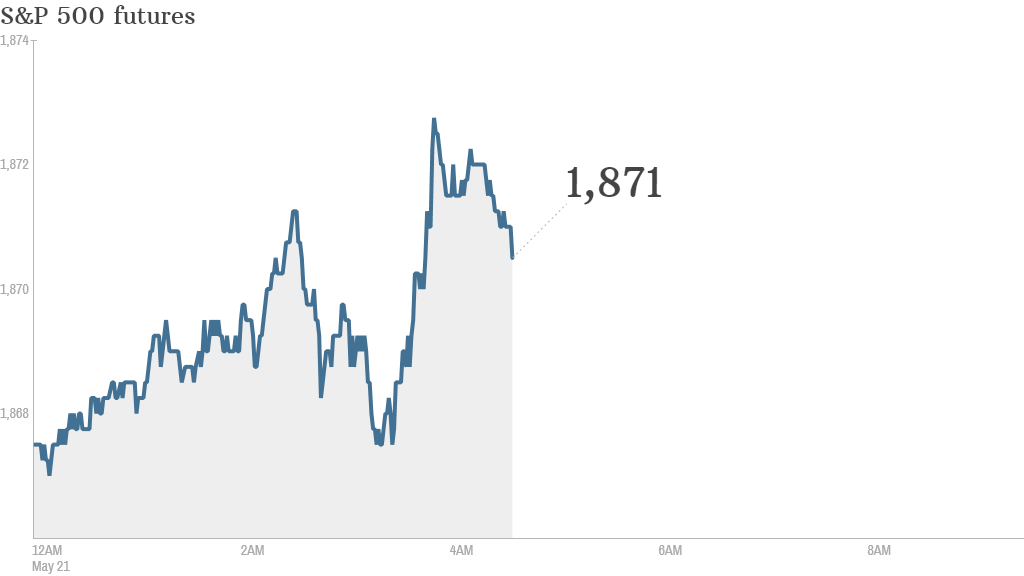

U.S. stock futures were stable ahead of the opening bell.

Many retailers will be reporting results Wednesday.

The sector may be able to redeem itself after a slew of retailers, from Staples to Dick's Sporting Goods, posted disappointing quarterly earnings Tuesday that showed Americans were spending less in brick-and-mortar stores.

Target (TGT), Tiffany & Co (TIF), Lowe's (LOW), and American Eagle (AEO) will report earnings before the opening bell. After the close, investors will hear from the company behind Victoria's Secret, L Brands (LB).

Shares in Burberry (BBRYF) were edging up after the luxury retailer reported full year results showing revenue increased by 17%.

U.S. stocks closed solidly in the red Tuesday, pushed down by those retail earnings. The Dow Jones industrial average fell 138 points and ended at a three-week low. The S&P 500 was off 0.65% and the Nasdaq down 0.7%.

European markets were slipping lower in morning trading.

Shares in BNP Paribas (BNPQF) were underperforming after Bloomberg reported U.S. authorities are seeking to slap the bank with a fine in excess of $5 billion.

Asian markets ended with mixed results. The Nikkei edged lower after the Bank of Japan monetary policy announcement.