The S&P 500 is gearing up for another possible record high Tuesday and it's worth watching a few key stocks that might be on the move.

Here are 4 things you need to know before the open:

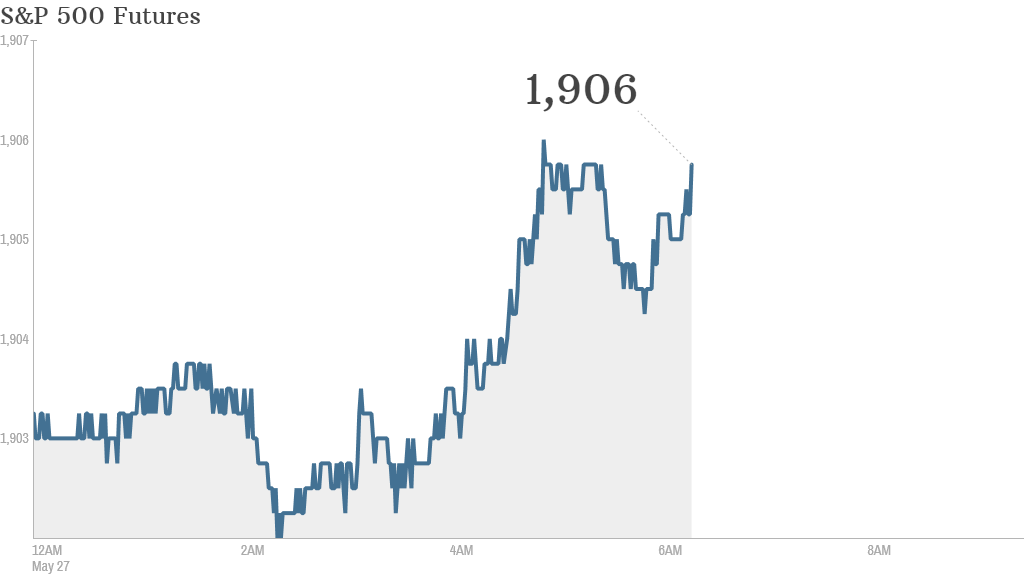

1. Fresh record highs in sight: U.S. stock futures were making solid advances ahead of the opening bell, indicating we could see new record highs.

U.S. markets ended on a positive note Friday. The S&P 500 closed at an all-time high of 1,900.5, while the Dow Jones industrial average rose by about 0.4% and the Nasdaq was up by nearly 0.8%.

2. Stocks on the move -- Hillshire Brands, InterContinental Hotels, AstraZeneca, Equifax, Michael Kors: Hillshire Brands (HSH) popped 22% in premarket trading on news that Pilgrim's Pride (PPC) has made a $6.4 billion offer to buy the company. It would be a $45 per share cash transaction. Hillshire stock closed at $37 on Friday.

Shares in InterContinental Hotels (IHG) were higher in London after Sky News reported the hotel chain rejected a secret £6 billion ($10 billion) bid by a U.S. suitor. The company declined to comment on the report.

Shares in AstraZeneca (AZN) were down as investors reacted to Pfizer's (PFE) confirmation that it would no longer pursue a mega-takeover of the British drugmaker.

Equifax shares were off and Michael Kors (KORS) shares were up ahead of the open. The fashion company will report results Wednesday.

Related: Fear & Greed Index sinks into extreme fear

3. Economic events: The latest S&P/Case-Shiller 20-city home price index will be published at 9 a.m. ET. This index provides a snapshot of how the U.S. housing market is performing. The price index is expected to have jumped at an annual rate of 11.8% in March, according to a consensus of economist opinion from Briefing.com, but that would be a slowdown from the prior month's increase of 12.9%.

The Conference Board will release its latest consumer confidence index at 10 a.m.

The government will release its monthly report on durable goods at 8:30 a.m. ET. A consensus of economists are expecting a decline of 1.3% in April, according to Briefing.com.

4. International movement: European markets had an eventful session Monday -- with some key markets up by over 1% -- but they were less enthusiastic Tuesday.

Investors brushed off European Union election results that showed far-right and far-left parties had gained additional traction. A majority of voters still supported traditional parties in the European Parliament.

Investors were also pleased that Ukrainian elections were completed without too many complications.

Asian markets were mixed Tuesday.