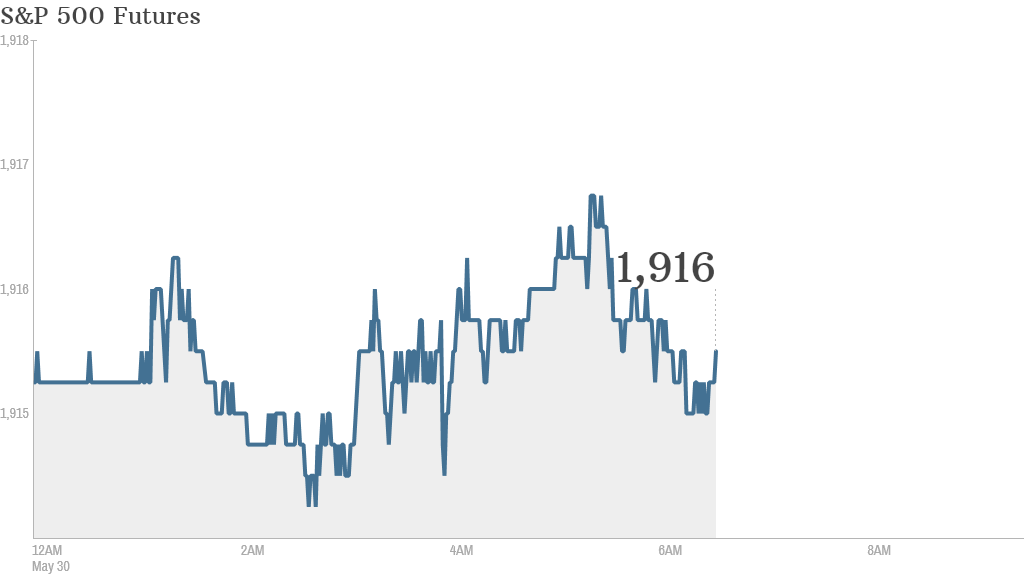

It looks like Wall Street will finish the month of May in positive territory, even though futures were showing a bit of weakness Friday.

Here are four things you need to know before the opening bell:

1. Stock markets have a spring in their step: So far this month, the S&P 500 has surged by nearly 2% to hit new record highs. The Dow Jones industrial average has gained 0.7% and the Nasdaq has posted a dramatic rebound after two months in the red, adding more than 3%.

But will the gains continue on the final day of trading in May?

U.S. stock futures were lower, indicating stocks could retreat from recent record-setting levels. The CNNMoney Fear & Greed index is in neutral territory.

On Thursday, the S&P 500 closed at 1,920, surpassing its previous record high from earlier this week. The Dow Jones industrial average closed 0.4% higher and the Nasdaq ended up 0.5%.

Related: Fear & Greed Index stalls in neutral

2. Market movers -- BNP Paribas, Salesforce, Ford: Shares in BNP Paribas (BNPQF) declined by roughly 5% in Europe after the Wall Street Journal reported that U.S. authorities were pushing the bank to pay more than $10 billion to settle a criminal probe of alleged sanctions violations.

Salesforce (CRM) shares were up in extended trading after the company announced a partnership with Microsoft (MSFT).

Ford (F) stock was under a bit of pressure after the automaker announced four recalls affecting at least 1.4 million vehicles.

3. Data, data, data!: The U.S. government will release personal income and spending numbers for April at 8:30 a.m. ET. The University of Michigan will publish a final reading of its May consumer sentiment index at 9:55 a.m.

4. International action: European markets were lower in morning trading, led by declines in the mining sector.

"A fresh record high for the S&P 500 has failed to enthuse London markets, as some worrying news from China sent miners lower," wrote IG analyst Chris Beauchamp in a market report, where he also mentioned concerns about weak manufacturing. "Warnings seem to be coming through with disturbing regularity, and the sharp drops in share prices that follow suggest that investor sentiment is far from being rock solid."

Asian markets ended with mixed results.

Investors in India are waiting for the latest report on quarterly GDP, which will be released at 8 a.m. ET. The Mumbai Sensex was little changed.